#7 Does sustainable investing work?

The world of investing has changed dramatically in recent years as more and more people and companies focus their investments on sustainability. But is sustainable investing really sustainable or is it more appearance than reality?

The motivation behind sustainable investing

Why are so many investors and companies choosing to invest sustainably? The main reason lies in the growing concern about environmental problems and social injustice. The climate crisis, pollution and social inequality are pressing issues affecting our world. Many people want to do their part to address these challenges.

Sustainable investing allows investors to put their money into companies and projects that minimize environmental impact, take social responsibility and promote ethical business practices. In this way, investors can use their capital to effect positive change in the world.

The core principles of sustainable investing

Sustainable investing is based on several principles and criteria. The most common are:

- Environment (E – Environment): This criterion refers to the environmental impact of companies and projects. Investors check whether a company implements environmentally friendly practices, reduces energy consumption and is committed to protecting natural resources.

- Social (S – Social): This is about corporate social responsibility. Investors evaluate how companies treat their employees, customers and communities. This includes working conditions, diversity and inclusion, and charitable initiatives.

- Governance (G – Governance): This criterion refers to corporate governance. Investors look at whether companies have transparent business practices, ethical governance, and independent oversight structures.

The promise of sustainable investing

There are often three main promises made in sustainable investing:

- Better returns: A common argument is that sustainable investing leads to higher returns. The idea is that sustainable companies are more stable over the long term and less prone to environmental impacts and social conflict.

- Less risk: Another promise is that sustainable investing reduces risk. Sustainable companies may be more resilient to environmental impacts and social unrest, leading to more stable investments.

- Positive Impact: Many investors hope to make a positive impact on the world through sustainable investing. They want to ensure that their capital is helping to minimize environmental impacts and promote social justice.

The reality about returns and risks.

The promise of better returns through sustainable investing is not new. It is based on the idea that active management and wise stock selection can generate higher returns than the overall market. However, research has shown that active management often has higher costs, but does not necessarily lead to better returns.

The claim that sustainable investing leads to less risk is, at its core, a promise of return. This is because return and risk are inextricably linked.

The positive impact dilemma

The biggest incentive for many sustainable investors is the idea of improving the world through their investments. But how exactly can this goal be achieved?

The hope is that sustainable investing will lower the cost of capital for sustainable companies, which it does to some degree. However, there is also a risk that other investors will simply help themselves to this difference.

The search for an alternative

Finding an alternative for investors who want to make a real positive impact is difficult. One alternative would be to buy part of an oil field and deliberately say that the oil should stay in the ground. Another alternative would be to buy oil-producing companies and instruct management to leave the oil in the ground. Both amount to the same thing. Both are extremely expensive.

The solution: A change in thinking

The solution to this dilemma does not lie in the financial industry. Instead, we should focus on addressing the fundamental global challenges to bring about long-term and sustainable change. This requires technological solutions and innovation on a global scale.

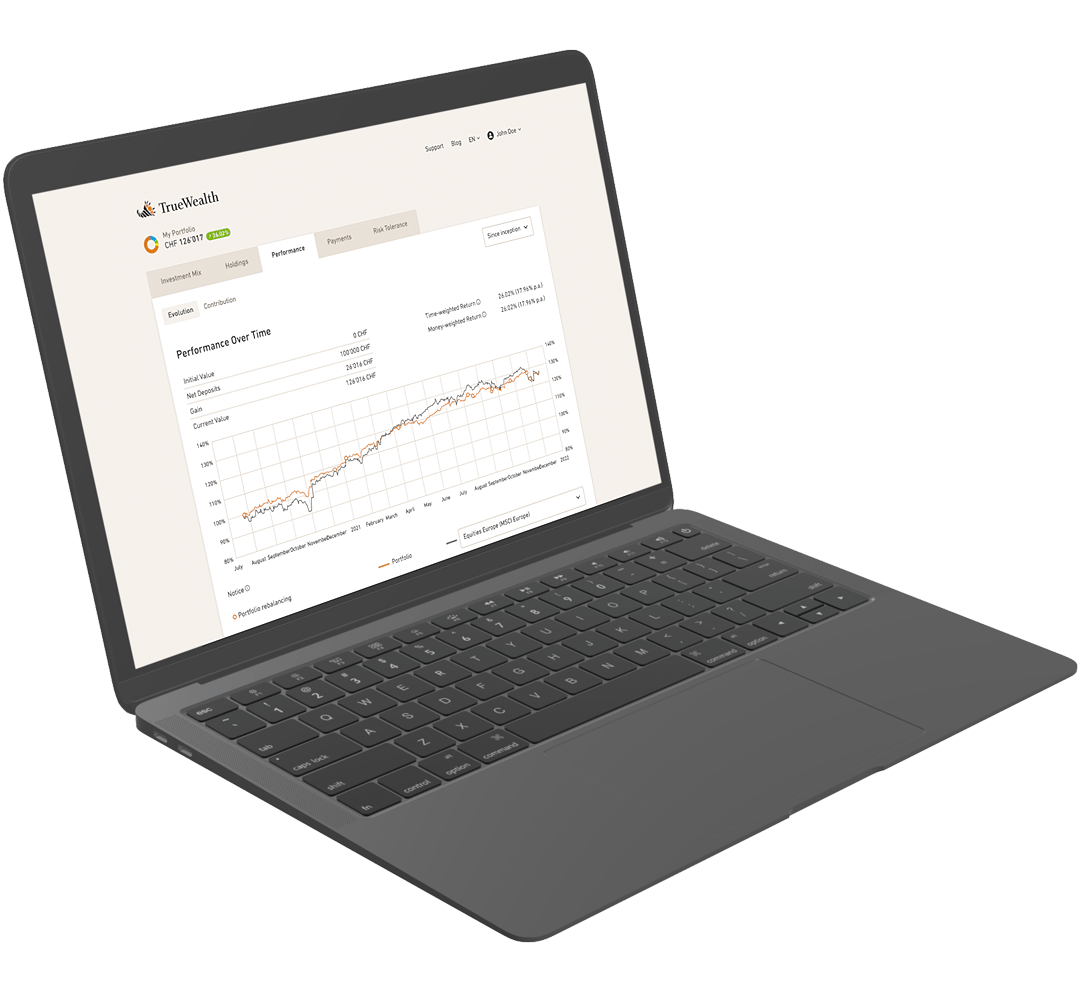

At True Wealth, we offer our clients the option to invest in both a global investment universe and a sustainable universe. Both options are cost-effective and transparent. We understand the importance of sustainability to many of our clients and want to give you the choice.

Link to the paper mentioned in the podcast: The Impact of Impact Investing

Would you like to learn more about this topic? Read our detailed blog on the topic of Greenwashing: The limits of ESG and impact investing

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account