The lowest fees in Switzerland

Low costs, highest transparency and an extremely user-friendly product: True Wealth tops offer comparisons.

Anyone considering an asset manager will first find out about the fees and all other costs involved in a mandate. After all, low overall costs bring higher returns. They're also easy to compare. To make the choice easier, in May 2022, the independent online comparison service Moneyland put digital asset managers under scrutiny.

Conclusion: With an asset management fee of 0.25-0.50% (see details here), True Wealth is the most competitive digital asset manager in Switzerland. A comparison table can be requested from Moneyland.

What's more, our wealth management fee already includes all of the following: Trading commissions, custody fees, risk tolerance assessment, periodic rebalancing, portfolio adjustments, deposits and withdrawals, a Swiss tax statement and statutory VAT.

The high markups linked to currency conversions are frequently forgotten in comparisons. These are of substantial importance for a globally diversified portfolio. Here, too, True Wealth offers attractive conditions: Markups of only 10 basis points or 10 pips (percentage in point) on the interbank rate, i.e. approximately 0.10% in relation to the foreign currency transaction volume. Since we automatically create four currency accounts (CHF, EUR, USD, GBP) with a personal IBAN for every newly opened account, we can optimise the costs even further for you. On the one hand, it becomes possible for you to deposit foreign currency holdings loss-free. On the other hand, a foreign currency transaction (for example, a switch from EUR to USD) can be carried out directly. The diversion via a single CHF account with a double FX settlement is no longer necessary.

Cost efficiency will continue to be a core promise of True Wealth. We achieve this thanks to consistent automation of processes, innovative product design and a skilful selection of investment instruments, as well as economies of scale: After all, with over CHF 800 million in client assets entrusted to us, we are now the largest purely digital wealth manager in Switzerland.

Most Transparent and Most Accessible

In May 2022, the Institute of Financial Services Zug (IFZ) and trend scout e.foresight published the third edition of their study «Digital Investing». The study authors assessed the transparency and accessibility of various offerings based on the following questions:

- Is the investment solution very clear and intuitive to use?

- Is the cost breakdown completely transparent and easy to find?

- Is extensive information available on building blocks, sub-allocations, currencies, etc.?

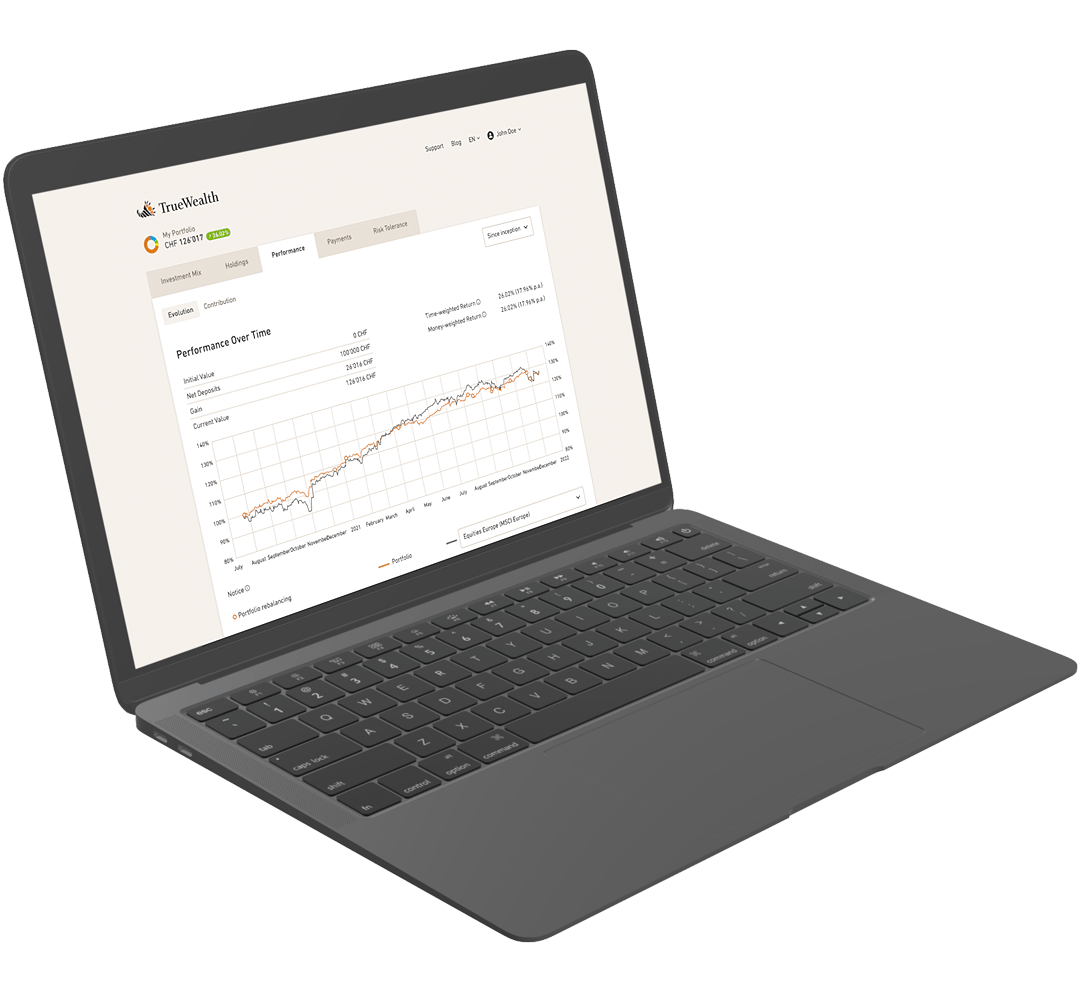

- Does the provider allow a strategy to be tested over time?

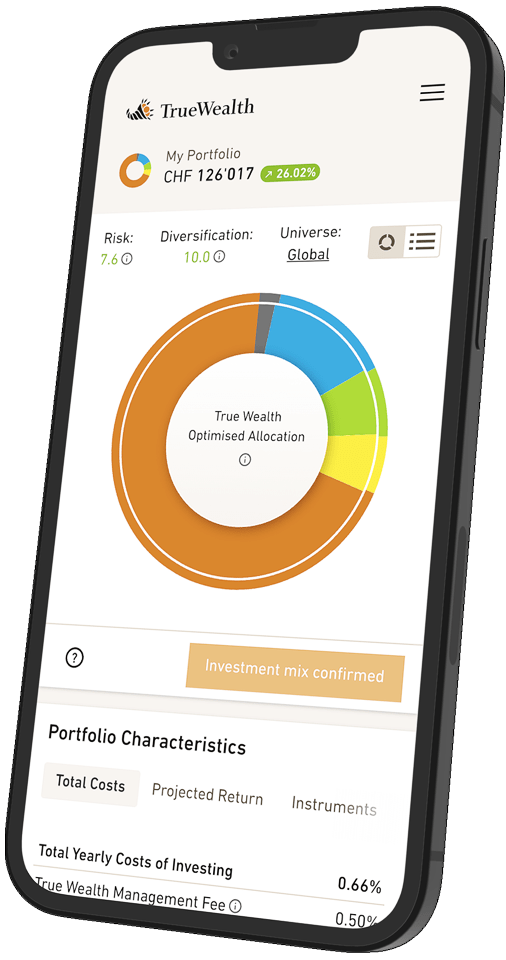

- Is the product optimised for desktop, mobile and app?

Conclusion: True Wealth is the winner of this category. Most transparent and most accessible. Scoring the maximum number of points.

Do you want to invest automatically? But don't want high costs? Try us out now and see for yourself.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account