Five Reasons why we build portfolios from ETFs

Why have we been consistently using ETFs at True Wealth for 10 years? Discover the top 5 reasons to use ETFs in your portfolio here.

Since True Wealth was founded 10 years ago, we've been building our clients' portfolios exclusively from exchange traded funds (ETFs). Why do we do this? Discover here are the five reasons why ETFs are the perfect building blocks for a modern portfolio:

Reason 1: Diversification is built in

For an optimal balance of risk and return, every portfolio needs diversification. The mix needs to span multiple asset classes, as well as different regions. Such a mix can be created from individual stocks. However, this is time-consuming and only possible with large assets.

With ETFs, good diversification is possible even with smaller amounts. Because diversification is already built into every ETF. An ETF tracks the performance of an index. Such an index contains various securities. Some of them are only a few: The Swiss Market Index contains exactly 20 stocks - and so an ETF on the Swiss Market Index also contains exactly these 20 stocks. In part, however, there are many: A common index on the American stock market already bears this number in its name - the S&P 500.

500 shares, that sounds like a lot. But even an ETF on a broad-based index like the S&P 500 is not enough for sufficient diversification. After all, it only reflects the performance of stocks - and only that of one country.

The MSCI World is even more broadly diversified. It includes more than 1'500 companies from 23 developed countries. The MSCI All Country World (MSCI ACWI) even brings the total number of individual components to over 9'000, because it also adds stocks from 24 emerging markets.

Even this impressively large number of individual stocks, however, does not change the fact that you are still only covering one asset class: Equities. If you want to diversify into other asset classes - and you should - then you need other ETFs for these exposures.

Reason 2: Access to all asset classes

The good news is ETFs exist for just about every asset class imaginable. In the early days of ETFs, pioneers had limited themselves to tracking stock indexes - today, ETFs cover an enormously broad investment universe:

- Bonds of all kinds

- Commodities

- Currencies

- Real estate

ETFs are traded on the major stock exchanges - everywhere where stocks also have their market. If you have access to the stock exchange via your broker, you can not only trade stocks there, but also all asset classes via ETF. Even those that could previously only be traded with derivatives (such as commodities) or with special accounts (such as foreign exchange).

All that is needed for an ETF is an index that describes and tracks the price development of this asset class. ETF providers then replicate this index performance and make it tradable in the market. In this way, ETFs open up access to all asset classes.

Reason 3: High turnover, high liquidity

How well a diversified portfolio works for your wealth is mainly seen in the long run. But even with a long-term horizon, sometimes you need to make a quick change. If you want to pay cash for a new car, for example, you need to be able to liquidate money quickly.

You can trade every single ETF on every trading day. Most of them have such a large trading volume that private investors can also sell large sums immediately without thereby influencing the market price to their own disadvantage.

Reason 4: Index as a strategy

Each index compiles a basket of individual stocks. How much of each stock is in the basket and which stocks it is composed of is determined at the beginning and regularly reviewed - but in no case continuously changed.

At least, that was the purist approach of the first ETFs. And that approach still applies to most ETFs, even though some indexes now follow a strategy that differs from market weighting.

At True Wealth, we rely almost exclusively on market-weighted indexes - the classic ETFs. These are almost always the cheapest and most liquid ETFs as well. But more importantly, they require minimal rebalancing and contain the market views of all investors worldwide. This modesty has a system and is the best strategy for long-term success in investing.

(Only in our sustainable portfolios do we use ETFs that are not market weighted - this is in the nature of things and is by design).

These classic ETFs track indices passively, without any market opinion of their own (other than that the asset class is attractive in the long term). But this is also an advantage for investors who want to determine their own strategy. Because even with this attitude, the strategy should not be overlaid by active strategies within an asset class. Passive funds serve as building blocks - the more stable, the more reliable.

You can also rely on this reliability if you do not want to put together your portfolio yourself. At True Wealth, we're happy to build you a portfolio that fits your risk tolerance and risk tolerance.

Reason 5: Low fees

An index is pure price information. In order for its value to be tradable, real transactions must be executed on the exchange. So a manager of an ETF must also do what any fund manager must do: Add or sell stocks or bonds.

For active funds, however, managers buy and sell frequently. For example, because they consider certain securities more attractive than others. Frequent trading results in high costs - and these gnaw away at the funds' returns.

A classic ETF is passively managed. The manager rarely has to trade. He does it only to keep the balance in the basket stable. For example, he will buy securities when investors have invested new money and sell them in return when investors have withdrawn money.

Because classic ETFs are passively managed, they incur much lower costs than active funds. And with nearly 10'000 ETFs now competing for investors' money worldwide, there are ongoing fee pressures. We put that to work for you: In the 'global' universe, we at True Wealth have been able to reduce ETF costs to just 0.15 percent.

How to create the optimal ETF portfolio

If you want to build the optimal portfolio from ETF, it takes two main steps:

First, select the universe. From almost 10'000 ETFs worldwide, select the ones you want to use for your portfolio according to clear criteria. Make sure that the liquidity is right and the fees are low.

Second, shuffle the portfolio. Determine your risk tolerance based on your risk tolerance and risk capacity. From that, deduce how heavily which asset class should be represented in your portfolio. Buy the right amount of ETFs from the investment universe to match (from step one).

You can take both steps yourself. For the selection of the right ETF you can use comparison tools like ETF Finder or justETF. For the portfolio, you can do weighting yourself.

However, it is most convenient to leave both steps to a professional wealth manager. For our investment universes, we regularly review all 10'000 products on the market. From them, we select only the best. Our algorithms ensure that efficient portfolios are created. These are not only optimally diversified at the outset - regular rebalancing keeps them on track.

Which ETFs do we use?

The ETF market is large and constantly changing. At True Wealth, we carefully select the best investment vehicles for you in each asset class.

ETFs from a variety of providers are used for our clients' diversified portfolios, depending on the asset class. Here are a few examples:

- Blackrock (for example iShares Core SPI ETF)

- Swisscanto (such as Precious Metal Physical Silver ETF)

- Vanguard (among others Vanguard REIT ETF)

- UBS (such as EURO STOXX 50 UCITS ETF)

- DWS Xtrackers (e.g. MSCI USA ETF)

SRI instruments are used in the sustainable investment universe, for example the iShares MSCI USA SRI. For Pillar 3a investments, we partly rely on index funds instead of ETFs, such as the CSIF Equity Switzerland Total Market Blue, for tax reasons.

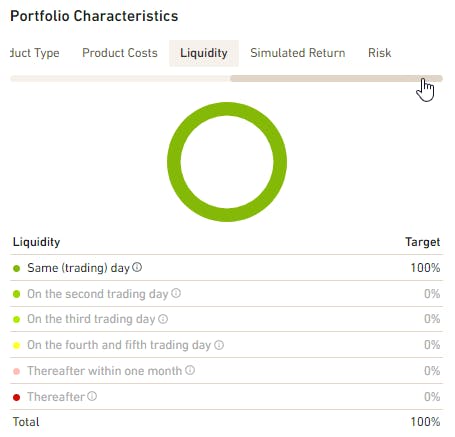

You can conveniently see which instruments are specifically used in your portfolio at any time in your personal dashboard. There you will find this information under "Portfolio Characteristics" in the "Instruments" tab. And you can do this regardless of how much money you invest with us - even if you test our offering with a virtual account and no money of your own.

An earlier version of this article was published on 29.05.2015.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account