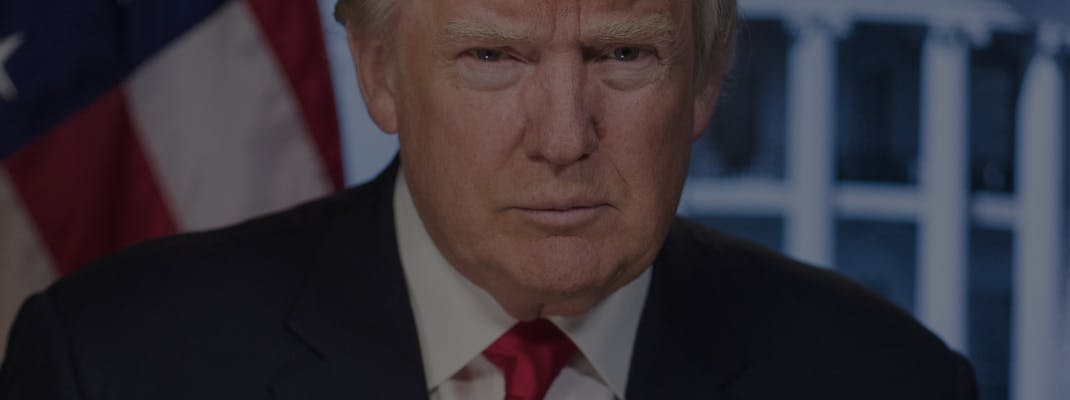

“Where is the Trump shock?”

Trump and the forecasts

The world eagerly awaited the Trump shock, but it never came. The forecasters were wrong once again.

When Donald Trump was elected the 45th President of the United States on November 8, political scientists around the world were in need of an explanation. The so-called “polls”, i.e., surveys conducted before election day, were unable to predict the result accurately in the majority of cases. However, November 8 and the days that followed also showed that most experts and forecasters in the financial sector were wrong once again.

Before the election

In the months leading up to the election, various forecasts were published claiming to be able to estimate how the stock market would react to a Trump victory. After all, the topic is also of great interest to the financial world - presidential elections almost always shape the financial markets. Two periods are particularly interesting here: The period before the inauguration and the actual term of office. It is difficult to predict how the market will behave during the term of office, as four years is a long time in the fast-moving financial world. It remains to be seen which policies can actually be implemented during the term of office. Contrary to popular expectation, however, the rule of thumb (only statistical, of course) is that the Dow Jones performs slightly better under Democratic presidents. Due to many unpredictable factors during the term of office, the period after the election and before taking office is of particular interest here. According to Alan Blinder and Mark Watson, who have studied economic performance depending on US presidents, this period shows whether investors have confidence in the incoming administration.

This is where the forecasts come into play. Many experts assumed that the market would experience a shock if Trump won the election and that share prices would fall. The main reason cited everywhere was the uncertainty that a new – and in particular Trump's – administration would bring. If Hillary Clinton had won, on the other hand, it could have been assumed that the previous guidelines would continue, whereas Trump's plans were (and are) less predictable. In addition, he does not always follow the traditional lines of the Republican Party, which makes things even more unpredictable.

After the election

When Trump was actually elected president, investors around the world watched the stock markets spellbound and waited for the predicted chaos. But this did not happen. The major share indices have climbed to unprecedented heights since the election, including the Dow Jones, the S&P 500 and the Nasdaq Composite. Volatility indices such as the CBOE Volatility Index (a barometer of fear, so to speak) have also reached low, i.e., reassuring, levels in recent days. Individual equities, particularly those from non-defensive sectors, have also benefited from the upturn. Incidentally, this also applies to certain Swiss companies. The main reasons for this are the promised tax cuts and the planned infrastructure projects. Industries to which Trump promised deregulation measures during his campaign are also currently benefiting immensely from the so-called “Trump Rally”. Which promises will actually be implemented during his term of office and what long-term impact the real estate mogul's plans will have on the global economy is still uncertain at this stage.

Passive investing and stock market shocks

The “Trump shock” has therefore failed to materialize for the time being. Nevertheless, there will always be unexpected events that turn the markets upside down. Investors – whether with a portfolio at True Wealth or elsewhere – therefore ask themselves the legitimate question of how their portfolio will react to such events and whether it is correctly positioned. But it is precisely in such situations that a passive, globally diversified investment strategy is the better option. History shows that unexpected, destabilizing events lead to higher volatility. This is because traders become nervous and start to trade. The passive – i.e. long-term – investor, on the other hand, sits back and waits until the market has recovered. History has also shown that the effect of such shocks is often digested within a month. In addition, a well-diversified portfolio can reduce the short-term damage, as all asset classes in a portfolio are never affected by a single event in the same way.

The events surrounding November 8 show us that although forecasts are certainly interesting, they should not be relied upon: the Trump shock has not materialized for the time being. Forecasts are much more uncertain than we would like to believe.

Links

- Richard Rubin: Donald Trump’s tax plan would boost economy in short run but not long term, analysis finds (The Wall Street Journal, 17.10.2016, Paywall):

Link Artikel Wall Street Journal - Alan S. Blinder and Mark W. Watson: PResidents and the U.S. Economy: An Econometric Exploration (Princeton University, July 2014):

Link Studie Princeton

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account