What to Look for When Choosing ETFs

You can easily manage an ETF portfolio yourself. However, a digital wealth manager like True Wealth offers clear advantages.

As an online wealth manager that manages clients' portfolios with ETFs, we are often asked why a robo-advisor is needed if you can manage the portfolio yourself. While it’s possible, the automated option offers significant advantages.

Finding the Best ETFs

True Wealth relies on ETFs, as these investment instruments allow for diversified and cost-effective investments in almost any liquid asset class. For pension solutions, index funds are also used due to their tax benefits. Not all ETFs are equally suitable for investors in Switzerland. If you intend to invest in ETFs on your own, you should take the time to decide which are best suited to your portfolio.

ETFs differ in various characteristics. Some of these criteria are highlighted below.

Active vs. Passive: ETFs are generally passive index trackers. They sparked the ETF boom and are still considered the gold standard today. True Wealth is also committed to passive ETFs, as active stock selection and market timing are mostly a matter of luck. Today, there are also actively managed ETFs. These are essentially active investment funds traded on the stock exchange. Not surprisingly, these are more expensive than their passive counterparts.

Tracking Error: The purpose of ETFs is to track the performance of a particular index (after costs) as closely as possible. They do this by buying the securities in the index with the same weighting. Theoretically, two different ETFs tracking the same index should have similar performance. In reality, this is often not the case, which is shown by their tracking error. This measures the deviation between the performance of an ETF and that of its underlying index. The lower the tracking error, the more precisely the ETF mirrors the index.

Total Expense Ratio (TER): Over the long term, even small cost differences can have a decisive impact on returns. ETFs offer the advantage of lower costs compared to actively managed funds. However, there are significant differences even between ETFs, so it pays to compare closely. The annual total expense ratio (TER) is best for comparing costs. Typically, ETFs from developed and liquid markets have a low TER of under 0.20%. Asset classes that are harder to replicate often come with higher costs. There are also cost differences between providers, even if they track the same index.

Bid/Ask Spread: This describes the difference between the price someone is willing to pay for an ETF (bid) and the price at which someone wants to sell it (ask). This difference is often determined by the ETF’s liquidity. The more frequently an ETF is traded, the smaller the difference should be. A low bid/ask spread means lower implicit costs for investors when buying and makes it easier to sell the ETF.

When choosing an ETF, Swiss investors should also consider fund size and tax efficiency. A large fund volume increases the chance of long-term success in the market. There’s also the replication method. Does the ETF actually hold the securities? This is called physical replication. Or is the underlying index replicated through derivatives such as swaps? That’s synthetic replication. Hybrid replication combines both methods to replicate an index.

With True Wealth, you don’t have to worry about selecting and assessing ETFs – that’s what we do for you. When selecting our investment universe, we look at low costs, market liquidity, counterparty risk, tax advantages, tracking error and the ETF’s structure. This ensures that only instruments meeting our high standards make it into client portfolios.

The Right Asset Allocation

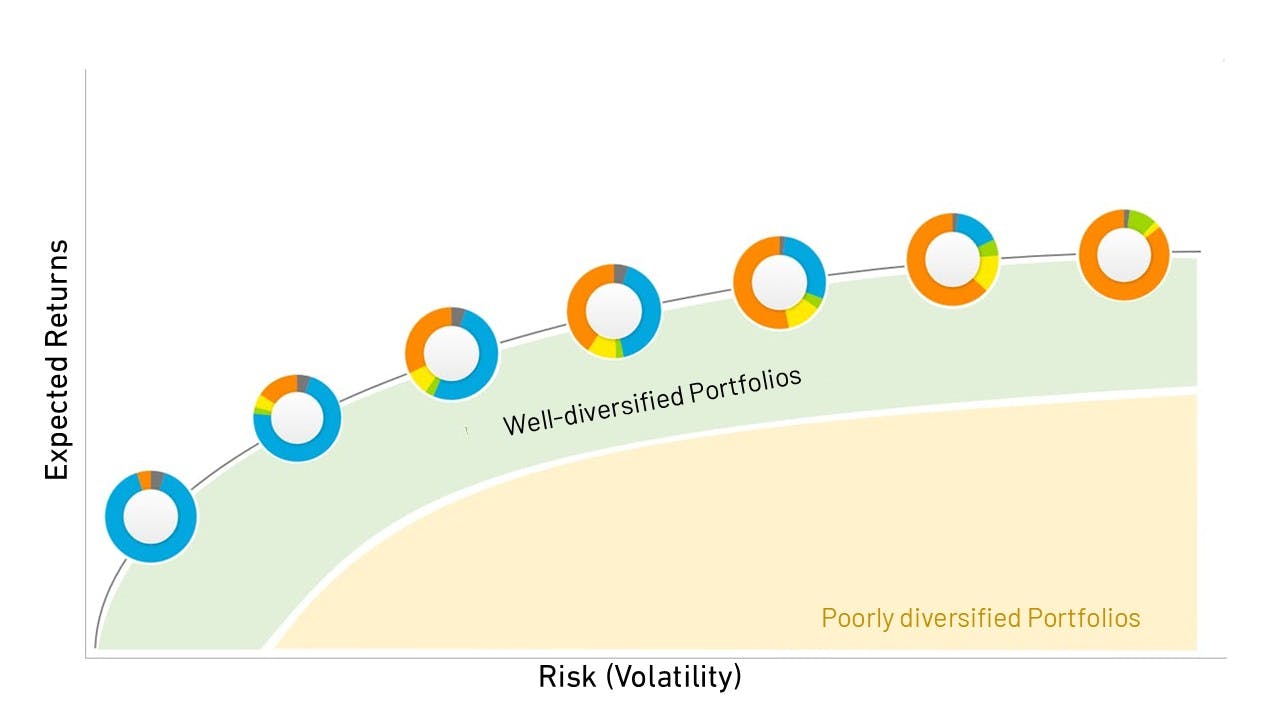

Once you’ve got your head around ETFs and chosen one or more to suit your needs, the next step is to think about asset allocation, i.e. your investment mix. This means spreading your capital across different asset classes, markets, and securities. Asset allocation should largely be determined by your risk tolerance and risk capacity – that is, how much volatility (value fluctuations) you are willing to accept, and how dependent you are on the invested capital. This prevents you from exiting too early during a downturn and potentially missing out on a market rebound. For example, if you opt for a defensive, low-risk strategy, a larger part of your capital will be invested in bonds.

At True Wealth, we determine your individual risk profile online. You fill out a questionnaire and immediately receive a portfolio proposal tailored to your risk tolerance. In total, we have defined over seventy model portfolio strategies that maximise expected returns for the given risk. You can also adapt the suggested portfolio as long as it remains within your risk tolerance and sufficiently diversified.

Regular Rebalancing

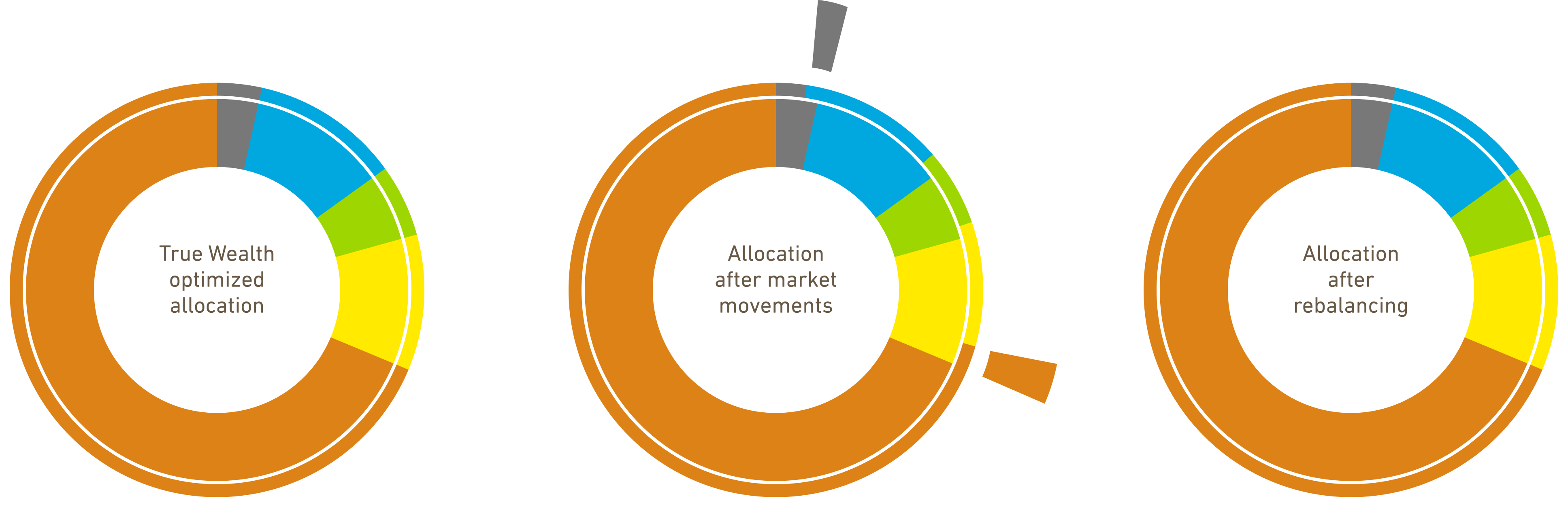

Your ETFs have now been purchased and your capital spread across different asset classes. As a portfolio manager, can you now sit back and let the market do the work? No, as the portfolio's internal weighting, in particular, needs ongoing monitoring. For example, if your equity ETFs perform particularly well, a defensive portfolio can quickly become too risky, as equity ETFs would then be overweighted. In this case, action is required: sell equity ETFs and buy ETFs from other asset classes to restore your target allocation. At True Wealth, however, we make sure not to trade too often – only when the deviations become significant.

This rebalancing is carried out automatically by True Wealth. If an asset class deviates significantly from the target allocation, we adjust the allocation accordingly. This ensures the portfolio never takes on too much or too little risk. We don’t rebalance on fixed calendar days, but whenever the market requires it. We trade every one to two trading days. This also means investments from deposits are made as quickly as possible.

Manual rebalancing, by the way, incurs transaction fees, which are already included in True Wealth’s management fee.

Time for Other Things

ETFs are particularly suitable for long-term investors who want to keep their costs low for better returns. So why should such investors consider a robo-advisor and pay additional wealth management fees? With a DIY portfolio, you end up paying other costs instead of an all-in fee. These include custody fees and transaction costs (brokerage, currency conversion fees, and minimum transaction charges) on buying, selling and rebalancing. You also shouldn’t overlook the time needed for all the steps and ongoing monitoring.

Our all-in wealth management fee of 0.25 to 0.50% (incl. VAT) covers it all: custody fees, trading costs, deposits and withdrawals, and the electronic tax report. Product fees are also low at 0.13 to 0.21%. But the True Wealth portfolio’s real advantage is in its convenience. Investors don’t have to compare ETFs or rebalance manually. A securities investment in Pillar 3a or an ETF portfolio for children is only a few clicks away.

Once the portfolio has been set up and your investment strategy defined, you don’t need to do anything else. If you wish, you can check performance or adjust your investment strategy at any time. We take care of everything else.

An earlier version of this article was published on 18.05.2017.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account