How can I adjust my portfolio?

Would you like to invest more in European equities or less in real estate? Find out here how you can adjust your portfolio.

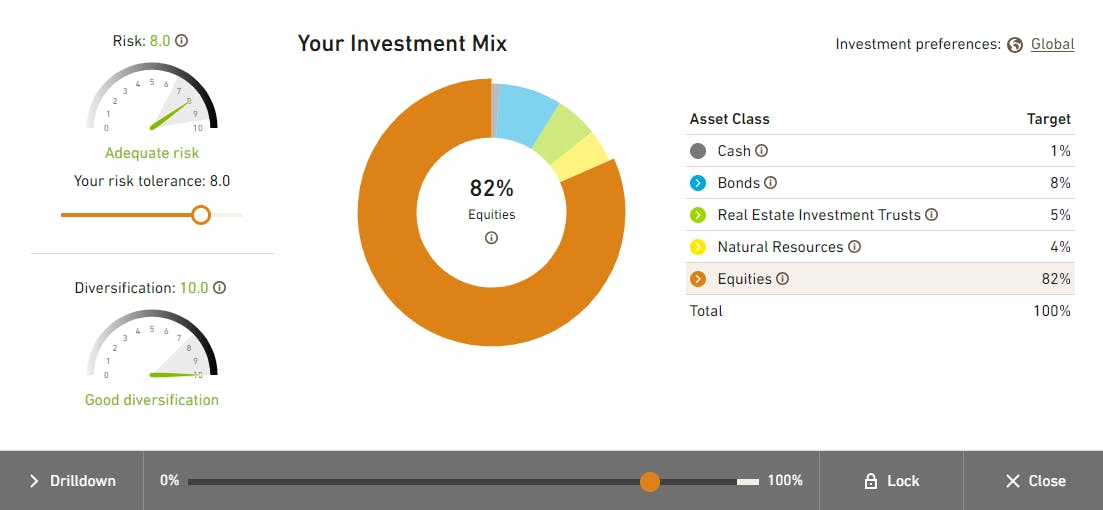

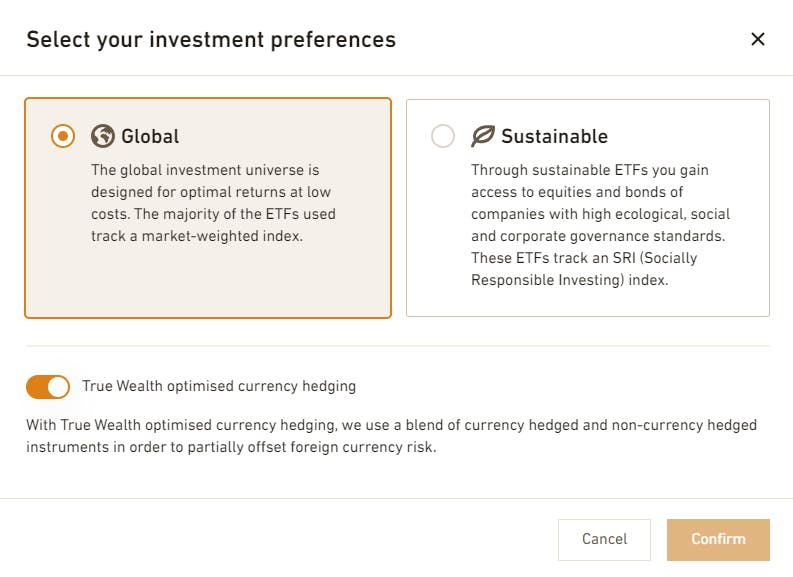

If you are a True Wealth client, we have determined your risk profile using our questionnaire. Our algorithm suggests the «True Wealth optimized investment mix» with the best possible long-term return expectations, depending on how much volatility you as an investor can and want to accept. You can also choose between the global and sustainable investment universe.

However, sometimes our clients want to incorporate their individual preferences for certain markets or asset classes into the strategy. As long as the portfolio remains sufficiently diversified and the personal risk range is not exceeded, our investment solution allows for extensive customization.

How to customize your portfolio

Let's assume you want to reduce your equity exposure in emerging markets. Log in to your True Wealth account (if you don't yet have an account, you can open a free test account). Click on «Equities» in the donut and then select «Drilldown» at the bottom left.

Click on «Emerging Markets» and adjust the percentage using the slider. The percentage refers to the emerging market share within the equity asset class, not to its share of the overall portfolio.

The procedure described above is the same regardless of whether you want to adjust the proportion of equities, bonds, real estate or commodities, or a sub-category thereof.

Does it change the return?

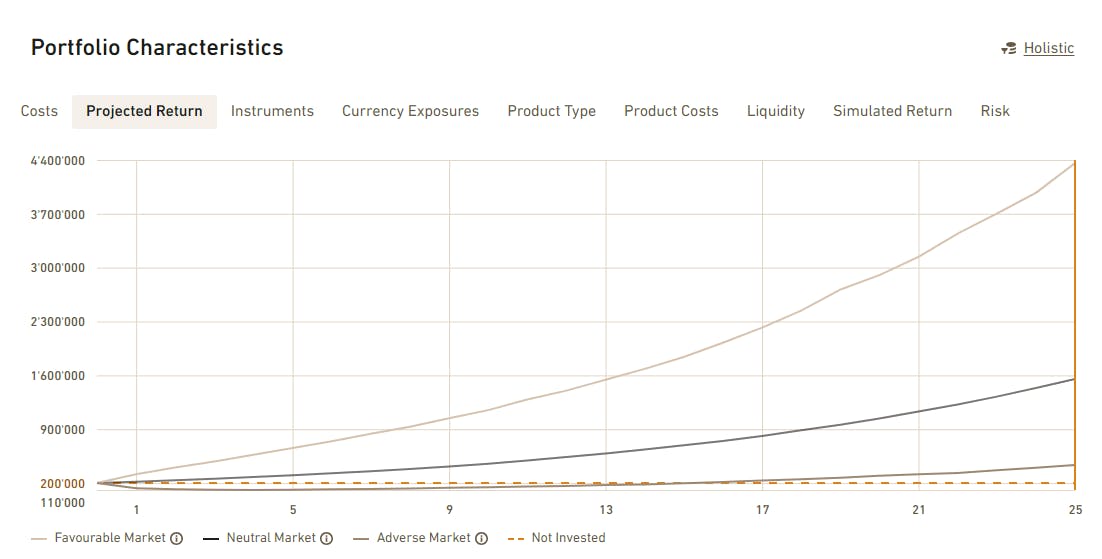

The «Projected return» shows you how your changes will affect your portfolio in real time.

Once you have made the changes you want, click on «Confirm investment mix». Your portfolio will be rebalanced at the next rebalancing, usually within a few days. We do not charge you any additional fee for the adjustments, and brokerage fees and trading commissions are included in our flat-rate management fee (for a full overview of prices, click here). However, when you rebalance your portfolio, you will incur unavoidable one-off transaction costs due to the bid/ask spreads and Swiss federal stamp duty. We therefore generally recommend that our clients only make such portfolio adjustments in small doses, if at all.

Partial currency hedging

The «True Wealth optimized investment mix» includes currency-hedged investment instruments for both asset management and Pillar 3a, to varying degrees depending on the portfolio risk. This partial currency hedging makes it possible to use a broader global investment universe, especially for those with a low risk tolerance, and to use your own «risk budget» even more efficiently. We discuss this topic in detail in our video podcast.

If you wish to deactivate the currency hedging, there is a switch in the «investment preferences»:

Transparency and flexibility

This example illustrates the complete transparency that True Wealth offers you when managing your portfolio, right down to the level of individual instruments. If you are happy with the investment strategy proposed by True Wealth, you can accept it and do nothing else. If you want to increase or reduce your investments in certain regions or sectors, or in the various asset classes – equities, bonds, real estate or commodities – you can do so at any time with just a few clicks of the mouse.

If your personal situation or investment horizon changes significantly, we recommend that you do not make any manual adjustments to the investment mix, but rather that you complete the risk tolerance questionnaire again. You will immediately receive a new «True Wealth optimized investment mix» proposal, of course at no additional cost.

About the author

Oliver is one of the founders of Switzerland's largest online shops: the online retailer Galaxus and the electronics specialist Digitec. Together with Felix, he launched True Wealth AG in 2013.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account