Greater transparency in terms of performance

As an investor you should pay attention to how funds and wealth managers handle withholding taxes and how they report performance. True Wealth is breaking new ground.

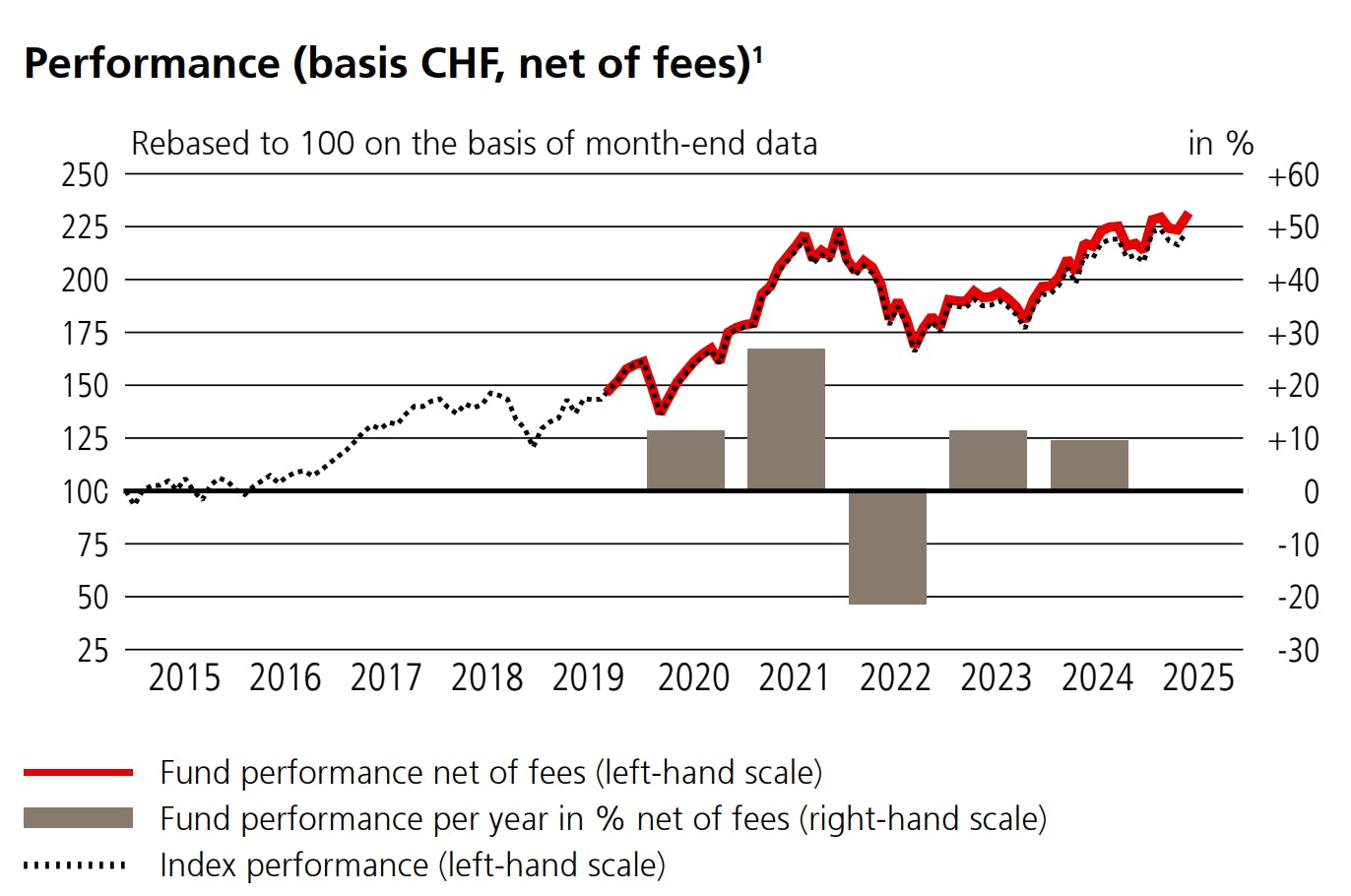

The fact sheet for a Swiss fund illustrates how tax issues can affect the performance shown. The accumulating UBS MSCI Switzerland IMI Socially Responsible ETF invests in Swiss blue chips such as Roche, Lonza, and Novartis. The fund's performance is shown in red (see chart).

At first glance, the fund outperforms its benchmark index, i.e. the black dotted line. However, this comparison is misleading. This is because the fund performance of this ETF correctly takes into account the investor's entitlement to a refund of anticipatory tax (Swiss withholding tax) on income such as dividends and interest. This leads to a better return. In contrast, the performance of the benchmark index in this case shows the net return without taking into account the claim to anticipatory tax, which makes the index's return look worse.

True Wealth with new methodology

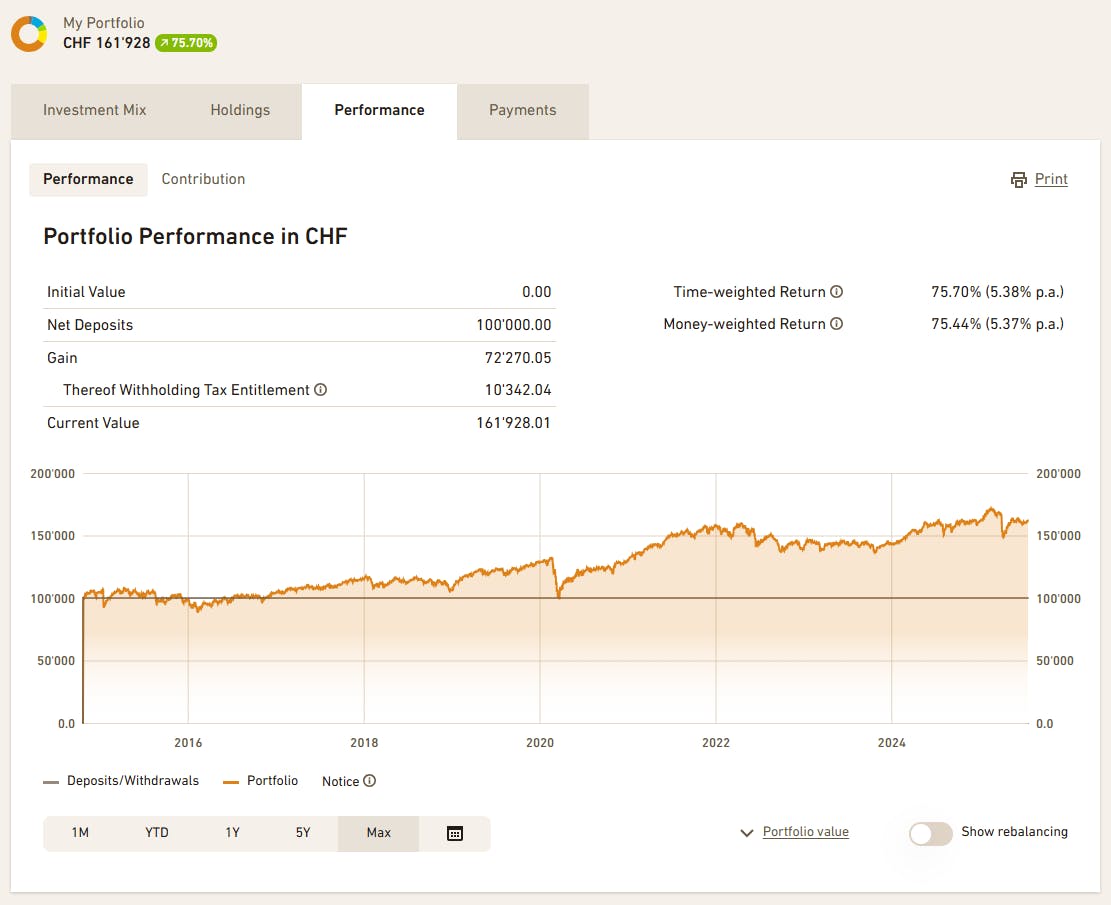

Until now, True Wealth reported returns without taking into account the claims of anticipatory tax and withholding tax abroad. This meant that in many cases the returns were slightly too low – at least for investors who can reclaim the withholding tax.

To ensure better comparability with capital market indices and other investment instruments, True Wealth now also takes anticipatory and withholding tax claims into account when reporting returns. This applies to both time-weighted returns (TWR) and money-weighted returns (MWR). We explain the difference between these two types of returns here.

Maximum transparency at True Wealth

In addition, the total anticipatory tax and withholding tax are shown transparently in an additional line. This makes it clear how many Swiss francs of the profit generated come from tax claims.

Simple crediting

With the free electronic tax statement, True Wealth clients can easily apply for credit for anticipatory and withholding tax. All relevant information is included in the tax statement, so there is no additional work for customers. Here you can find further information.

Fund domicile is decisive

A domicile in Switzerland is a prerequisite for reclaiming anticipatory tax. This also applies to funds. True Wealth therefore takes care to keep the number of foreign funds with Swiss equities and bonds as low as possible.

Funds that invest in the US and are domiciled in Switzerland should be avoided.

These can be identified by the country code in the ISIN (beginning with CH). In this constellation, a full 30 percent of the income is lost and cannot be reclaimed. True Wealth also optimizes the fund selection for its clients in terms of tax efficiency and selects US ETFs domiciled in Ireland or the US accordingly.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account