Negative Interest

Negative interest rates: These are your two options

Negative interest rates, coupled with high fees and inflation, mean savings are continually shrinking. Read more to learn about an efficient and effective way of escaping this downward spiral.

Negative interest rates, coupled with high fees and inflation, mean savings are continually shrinking. An efficient and effective way of escaping this downward spiral is to make targeted investments. The key here is to achieve broad diversification at low costs.

Swiss National Bank introduces negative interest rates

The Swiss National Bank (SNB) sets Switzerland’s monetary policy independently and in the interests of the country as a whole. Its main goal is to maintain price stability, taking economic developments into account. Like other central banks, the SNB steers monetary policy primarily through interest rates. Negative interest rates are designed to boost demand and counter deflation, as well as dampen the Swiss franc’s appreciation. Economically, negative interest rates affect exchange rates, loans, and asset classes such as shares, bonds and real estate.

Negative interest: made in Switzerland

If the inflation rate exceeds nominal interest rates, real interest rates turn negative. This is nothing new, but negative nominal interest rates are relatively new. And who invented them? The Swiss. In 1972, Switzerland became the first country to introduce negative interest rates. An unconventional measure at the time, its purpose was to prevent the inflow of what was known as hot money. The ordinance in question was repealed only a few years later, in 1979. Before and after, negative interest rates were not a feature of either economic theory or monetary policy. Until in 2012 the Federal Republic of Germany issued several bonds at negative yields, pocketing a premium in 21 of a total of 70 bond auctions. Over this period, countries ranging from Denmark and the Netherlands to France and Japan made similar interest rate moves.

Rescuing the euro and Swiss franc appreciation

In June 2014, the European Central Bank (ECB) became the first major central bank to set an interest rate of -0.1%. From then on, commercial banks had to pay interest on money they deposited with the central banks but which they had no need of in the short term. This measure was aimed at making it less attractive for commercial banks to deposit money with the ECB, encouraging lending and stimulating the economy. Although there was blatant disagreement about negative interest rates, even within the ECB, and at times heavy criticism from politicians, business and the general public, the intended effect on the capital and money markets did materialise. Experts believe that Mario Draghi’s promise to do ‘whatever it takes’ rescued the euro from its debt crisis, thus playing a significant role in saving the European single currency – but the euro’s weakness inevitably caused the Swiss franc to appreciate.

Minimum exchange rate and negative interest

As a counter-reaction, the SNB set the minimum euro-franc exchange rate at CHF 1.20 in autumn 2011 – in part to protect Switzerland’s economy and its important export industry. Some three years later, it announced the introduction of a negative interest rate of -0.25% on current accounts. At the same time, it reaffirmed its commitment to the minimum exchange rate, which it would ‘continue to enforce with the utmost consistency’. But by 15 January 2015, the minimum euro-franc exchange rate was already history, and only a week later negative interest rates became a reality. This remained the case until the SNB meeting in September 2019, when it announced its policy rate would stay at -0.75%.

Higher account balances, higher negative interest

Given developments at central and national banks, the question was not whether commercial banks would pass on negative interest rates to their customers, but when. German banks introduced negative interest rates in November 2014, followed about a year later by the first Swiss retail bank. By autumn 2019, the number of Swiss banks that applied a negative interest rate to retail and private customers had risen to a total of 13. At the same time, limits above which negative interest was charged have fallen. Depending on the financial institution, this ranges from CHF 50,000 to CHF 1 million at interest rates of -0.125% to -1%. What is noticeable is that higher account balances usually incur a higher negative interest rate.

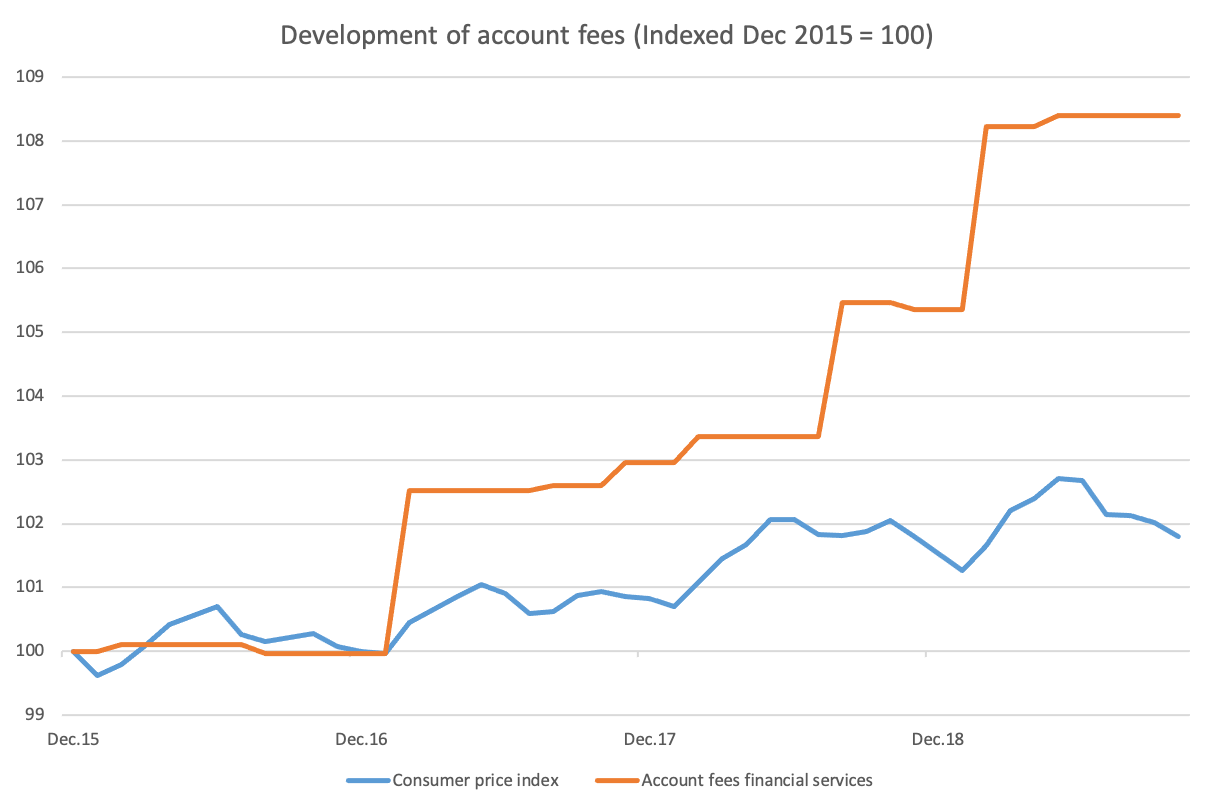

Bank charges used to offset negative rates

Thus, this measure passes on the negative interest rates charged by national banks. It is also designed to encourage retail customers in particular to invest their cash. Those who continue to save their money not only receive less interest and compound interest, but also pay higher fees for services received – be it in retail or private banking. Despite the commotion about negative interest rates and high bank fees, a mass exodus by the Swiss – who are known for their reluctance to switch – to cheaper alternatives has not materialised. That said, these are found mainly at innovative and highly specialised, digitalised and automated online providers.

Nomen est Omen: Negative

It would be counter-productive, not to say paradoxical, if for fear of further reductions in old-age pensions, employees began saving alongside the basic pillar 1, the occupational pillar 2 and the voluntary pillar 3. And at negative rates coupled with inflation, however moderate that might be! This means that not only money but also purchasing power evaporates. In order to avoid the effect of negative interest rates on years of savings, people are investing more cash, which can lead to bubbles – particularly in illiquid markets, where price is defined by sheer demand.

Broadly diversified thanks to ETFs

Regardless of whether the reason is low interest rates or high fees, or whether you are a new or experienced investor, the current poor circumstances mean that building a portfolio is particularly challenging. The focus is on targeted development and broadly diversified sources of return. This also applies to True Wealth: as a Swiss online asset manager, our passive investment approach is based on cost-efficient ETFs (exchange traded funds). These instruments track a specific index, so by definition are very broadly diversified. And when selecting funds, we also take into account their structure, index tracking, liquidity and costs. The composition of a client’s portfolio is always based on their personal risk profile, as determined in our online questionnaire. If a portfolio strays from this original asset mix, it is automatically rebalanced to achieve a sustainable return for the client.

Take all factors into account

In light of the negative interest rate environment, we see two valid options from our perspective as an asset manager: either you invest your money long term on the basis of your personal risk profile and take just as much risk as you can bear in the event of a market collapse. Or you are prepared to pay a surcharge in order to keep your money safe; for example, in a classic account. Either way, it is advisable to weigh up and compare – impartially – all options, whether or not you invest online. And you should pay particular attention to hidden risks and costs. If, for example, you keep bank notes in a bank vault, factor in insurance costs as well. In the case of cash alternatives such as structured products or cash deposits with debtors that are not gilt-edged, the counterparty risk must be assessed. And be aware that the deposit protection at Swiss banks is limited to CHF 100,000 – at higher amounts, clients run a counterparty risk. Since only banks are allowed to hold an account with the Swiss National Bank, cantonal banks with a state guarantee are probably the only exception for private individuals. So in conclusion, a fair comparison is possible only by looking at default risks and hidden costs.

Low and transparent costs

Negative interest rates and rising costs mean that savings are continually shrinking. But investors, and not only savers, would do well to keep a close eye on the costs they incur, because minimising costs is the first and simplest step towards maximising returns. At True Wealth, we rely not only on cost-effective ETFs, but also on digitised, fully automated processes. And at 0.5%, our management fees are also lower than those of traditional financial institutions. This half percent includes custody account fees and costs for all transactions, deposits, withdrawals and the Swiss tax register. And we don’t accept kickbacks – so our costs are transparent and in some cases cheaper than negative interest and bank fees. All in all, reducing cash and investing the funds released in a targeted way is an attractive alternative to the current negative interest rate environment.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account