Bonds in Inflation: Safe is Suddenly No Longer Safe

Normally, bonds provide security to your portfolio. In periods of inflation, only one thing is certain: With bonds only, your assets will shrink.

For years, negative interest rates have made it difficult to achieve any return at all with bonds. Now inflation is also eroding their nominal value. And if interest rates rise in response to inflation, bonds can lose value.

In phases of inflation, bonds are therefore bad in several ways. In other market phases they provide security in the portfolio. In periods of inflation, only one thing is certain: With bonds, your assets will shrink.

What can you do about it? In the second half of the article we show you how best to deal with bonds in your portfolio. Whether you need to make a decision. And if so, about the best way to implement it.

Bonds: The Most Important Risks

To help you make a decision with confidence, let's first look at the basics – the main risks of bonds.

Default Risk

Bonds are debts. It is not only important that they yield interest. What is most important is that they pay back the amount invested.

But this is not always the case. Whether states like Argentina or Greece, or companies like Swissair, Enron or Wirecard: Time and again, debtors falter. They go bankrupt, become insolvent – or are saved from bankruptcy by a partial waiver by the creditors.

That is why every bond carries a default risk. It is also called issuer risk, counterparty risk or credit risk. Debtors with a low credit rating must therefore usually pay a higher interest – a premium for a possible default. Debtors who have always fulfilled their obligations and – in the case of companies – have a strong balance sheet and earnings power, on the other hand, pay less interest. In some cases, as with the Swiss Confederation, they even charge interest for lending them money.

Therefore, if you want to make a return at all, you cannot rely exclusively on the very safest debtors. For your portfolio at True Wealth, we therefore also rely on corporate bonds. By using ETFs, the risks are well diversified.

Currency Risk

When they invest in bonds, most investors in Switzerland also invest in bonds denominated in other currencies. Bonds in Swiss francs have historically always had a particularly low-interest rate level – this has not improved in the current interest rate environment. Better returns can often be achieved in other currencies.

In your portfolio at True Wealth, ETFs therefore also often include bonds in euros, US dollars and British pounds. These ETFs include both government bonds and corporate bonds. In addition, some portfolios contain ETFs on high-yield corporate bonds and bonds from emerging markets, i.e. high-yield bonds from debtors with less good credit ratings – mostly in US dollars, less frequently in other currencies.

Returns in foreign currencies contribute to additional diversification in the portfolio, but also entail the risk of currency fluctuations.

Sometimes this risk turns out to be an opportunity. Hard currencies from stable countries often appreciate when market interest rates are higher there. We can currently see this in July 2022 in connection with interest rate hikes in the US dollar. This interest rate differential also occasionally drives the currencies of emerging markets. There, however, the opposite effect may be observed as soon as the market doubts the stability. Then the Brazilian real or the Turkish lira experience sometimes dramatic exchange rate losses.

In principle, you can hedge the foreign currency risk, at least in the most important currencies, with futures contracts. Or invest in a currency-hedged ETF that already does this within the ETF. However, one should be under no illusions here: The interest rate difference between the interest rate level of the foreign currency and the interest rate level in Swiss francs is generally priced into the price of the foreign currency forward contract and therefore disappears as soon as you hedge the currency risk.

Interest Rate Risk

For the vast majority of bonds, the interest rate is fixed exactly once: At the beginning of their term, when they are issued. Paradoxical as it may sound, it is precisely because the interest rate is fixed that the price of the bond fluctuates – it is subject to interest rate risk.

This risk is also called market risk. This is because: If the market interest rates rise, new bonds with better interest rates come onto the market. Old bonds with the old interest rates yield less in comparison. They are therefore worth less.

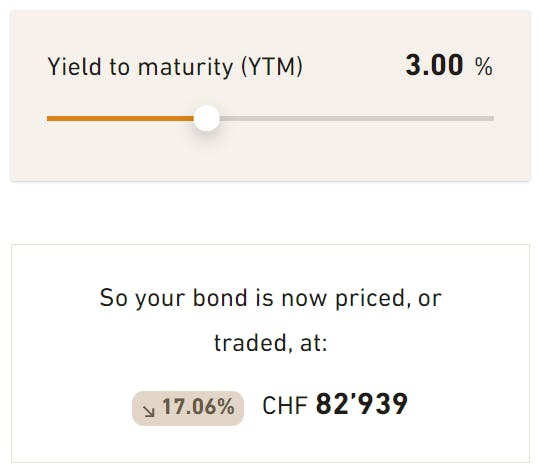

Let us briefly calculate this using an example:

A bond with a nominal value of 100'000 francs that pays 1 per cent for ten years will have paid out a value of 110'000 francs in total at the end of its term. Let's call it the old bond.

Let's assume that today a new ten-year bond comes onto the market that pays 3 per cent interest. At the end of its term, 100'000 francs will have become 130'000 francs.

How much is the old bond worth today? Only 82'939 francs – a whole 17'061 less than the nominal value of 100'000. Expressed as a percentage: More than 17 per cent less!

At first glance, such an increase in interest by two per cent seems like a small step. But in our example, from 1 to 3 per cent, it is a threefold increase. With correspondingly drastic consequences.

The loss would be even greater if the term were longer. If it is 30 years, then the price after the interest rate increase is only 60'799 francs – a loss of almost 40 per cent. Besides the interest rate change itself, the years to maturity are the decisive lever. Another name for the same risk is therefore called maturity risk.

Bonds fall in value when interest rates rise. Extract from our bond calculator. If you want to calculate this yourself, here is a clearly laid out bond calculator.

Inflation Risk

Inflation risk in the narrower sense describes the effect of inflation on the nominal value of the bond (i.e. the capital owed to you as an investor) and on the coupons (i.e. the interest you receive year after year). Both figures, nominal value and coupon, remain the same in nominal terms. However, inflation eats away at purchasing power – so in real terms the value falls.

In a broader sense, inflation also drives the three other risks: Inflation causes more debtors to falter, so the risk of default increases. Currencies from countries where inflation is particularly strong usually depreciate against hard currencies like the Swiss franc, so the currency risk increases.

When central banks want to combat inflation, they have often resorted to interest rate hikes in the past. Raising the base interest rate does cool down the economy, while it also carries the risk of a recession – but is often the only remedy against inflation. A rate hike can slow inflation (and preserve purchasing power) – but for bond investors it comes with all the disadvantages of the interest rate risk.

Bonds: This is Why They Are in The Portfolio (Usually)

Shares, real estate, commodities – all real assets come with fluctuations. Their yields are often higher than those of bonds. But their prices are volatile. That is why portfolios are not only built from real assets. As a rule, a large proportion of bonds is used because bonds offer two advantages:

Negative Correlation. Bonds often react differently in the market than equities. Their price moves in the opposite direction. Statisticians say: They are negatively correlated. Or, to put it simply: When stocks go up, bonds go down – and vice versa (but not always). Read more about this in our article: Put all your eggs in one basket: Diversification.

Lower Fluctuation. On the other hand, people usually bet on bonds because their prices change much less. The lower fluctuations of bonds alone ensure that the total assets fluctuate less.

However, during a period of inflation, bonds slowly but steadily lose purchasing power, or real value, even if interest rates are not increased. If interest rates rise, they lose additional value. In phases of inflation, the negative correlation should also mean that bonds fall, for example because of a change in interest rates – which is precisely when shares may rise.

Bonds: Do I Need Them?

One thing is clear: In the long term, over decades, equities are superior to bonds. However, bonds stabilise a portfolio against short-term fluctuations in value.

In times of inflation, however, bonds can only play this role, which they fulfil for the portfolio in normal market phases, to a limited extent. This leads to only one conclusion: Bonds should be reduced to a minimum. If you can withstand the fluctuations in value of equities and other real assets, keep the proportion of bonds small.

For the sake of better diversification, however, you should not completely do without debt instruments. Depending on your individual situation, a share of 15 per cent in your total assets may already be sufficient to benefit from the effect of diversification.

You may already hold enough bonds in your pension fund to achieve such a share of your total assets. Legal regulations and the statutes or a lack of coverage mean that every second pension fund currently holds 27 per cent or more of its assets in bonds, and some even hold more than 50 per cent.

For the part of your assets under your control, you can take countermeasures – and do what your pension fund cannot do so easily:

More Real Assets? Check Your Risk Tolerance!

Check your risk tolerance with our risk profiling. We will do the rest for you!

If your risk tolerance is low, you should only invest in real assets to a limited extent, and you are then left with bonds and cash. However, if you can tolerate major fluctuations in value over a time horizon of several years, real assets, especially equities, are attractive in the long term.

Read here which asset classes best preserve value in periods of inflation and why we at True Wealth use them in your portfolio – Inflation: Protecting Wealth with Real Assets.

Inflation-Linked Bonds in The Portfolio

There are also bonds whose value is linked to inflation. With these, the official inflation figure is determined in advance. Then – depending on the variant – either the coupon is adjusted year by year. Or the nominal value as such increases or decreases (and with it the coupon).

In the market for inflation-linked bonds, there are almost only government bonds of developed countries – unfortunately, these are the issuers with the lowest yields. The link to inflation costs additional foregone interest. One can therefore not expect a serious return from inflation-linked bonds.

Bonds like Treasury Inflation-Protected Securities (TIPS) in the US have been around for decades. ETFs of inflation-linked bonds have been on the market for years and are also available for your portfolio at True Wealth.

With ETFs of Inflation Linked Bonds, you can absorb the loss of purchasing power and cushion the interest rate risk. Interest rate risk only exists when real interest rates rise – that is, nominal interest rates rise more than inflation.

Cash instead of Bonds in The Portfolio

Yes, a small counterweight to real assets makes sense. In normal times, this is solved in the portfolio with bonds.

In times of inflation it can make sense to use cash instead of bonds for this purpose. Cash does nothing against the inflation risk in the narrower sense, i.e. the loss of purchasing power in the nominal value. But it does counter the interest rate risk.

To be clear: By cash we mean the asset class. You don't have to put the money under the mattress or in a safe. A bank account is enough. The negative interest you have to pay on it, depending on the bank and the balance, could be much less than the loss in value if interest rates change. But don't worry: At True Wealth, to date, there is no negative interest on cash. And depending on your choice of custodian bank, your cash deposits at True Wealth are protected by a state guarantee.

Depending on the situation, some of the Swiss franc-denominated bonds in the portfolios optimised by True Wealth are also converted to cash. You can see this under your investment mix in the portfolio properties under the Instruments tab.

What to Do?

The time for simple investment solutions is over. But stay calm!

Before you change manually the investment mix in your True Wealth portfolio – which is very easy to do: It is even easier for you to redefine your risk tolerance in your True Wealth account. If your situation hasn't changed, you don't even have to answer all the questions again.

You will then immediately receive a new portfolio optimised by us as a new investment proposal, with a proportion of real assets that is suitable for you.

This article is part of a series on inflation:

- Read here what real assets are and how important they are for long-term investment success – Inflation: Protecting Wealth with Real Assets.

- In our article – Inflation: The Tax Nobody Wants to Pay we explore where inflation comes from, who it benefits and what it means for you.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account