Everything you need to know about Pillar 3a withdrawals

Saving for private retirement significantly increases your retirement assets and offers tax advantages – not only when you contribute. What do you need to bear in mind when withdrawing your savings?

According to the Federal Statistical Office and an analysis by the Swiss Provision Association, 62 percent of the working population makes use of the third pillar. It can therefore be assumed that there are a good three million 3a savers. As of 2022, they have accumulated retirement assets of around CHF 140 billion. According to the Swiss National Bank, CHF 57.7 billion of this is held in 3a savings accounts. The rest is spread across 3a insurance policies and securities solutions. Although the latter only account for a fifth of 3a funds, they are becoming increasingly popular.

These are therefore economically significant sums that pension savers will one day be entitled to withdraw. And there are a number of things to bear in mind when doing so.

When can you start withdrawing funds from a Pillar 3a account?

Ordinary withdrawal is possible at the earliest five years before reaching retirement age. You must have withdrawn your 3a funds by your 65th birthday at the latest, unless you continue to work (i.e., receive income subject to OASI contributions).

As part of the OASI21 reform, the reference age for women will be gradually increased from 64 to 65.

Quarterly increments apply to women born between 1961 and 1964. A concrete example: A woman born on June 1, 1962, will retire at the normal retirement age of 64.5. She must therefore withdraw her pension assets by December 1, 2026, at the latest.

How flexible is regular withdrawal?

Unless otherwise specified, most 3a foundations operate on an «all or nothing» basis. Anyone who closes a 3a account must withdraw the entire amount at once. Subsequent division of the 3a account is not permitted. This is inflexible and can lead to high tax burdens depending on the canton (see table below).

There is no legal limit to the number of 3a accounts a person can have. However, many pension foundations only open multiple accounts at the explicit request of their customers. In practice, many savers find out about this option too late. They are then forced to withdraw their 3a money in one year. This is not the case with True Wealth, where the 3a funds paid in are distributed across five accounts. They can be withdrawn in different years in a tax-optimized manner. You can calculate your savings with our tax calculator.

How long can you defer withdrawal?

Anyone who can prove to the provision foundation that they are still working may continue to pay into Pillar 3a for five years beyond the normal retirement age and defer the taxable withdrawal. However, you must withdraw your pension savings by your 70th birthday at the latest.

Over how many years can you withdraw your 3a money?

Good planning begins years before retirement. For example, you can take an early withdrawal at the age of 59 or even earlier to renovate your kitchen. We will discuss «early withdrawal» in more detail at the end.

Good to know: Even in the year of withdrawal, you can continue to pay into Pillar 3a if you are employed or receiving unemployment insurance benefits.

Of course, if your financial situation and personal risk appetite allow, the money you withdraw can be reinvested in securities as part of your free assets. The investment horizon here extends at least until your death or even beyond if you are thinking of your heirs.

Anyone who still has vested benefit accounts or policies can defer their withdrawal until the age of 70 at the latest, even if they are not in gainful employment. This is possible until December 31, 2029. After that date, you will have to prove that you are in gainful employment if you wish to retain your vested benefits beyond the statutory retirement age.

How is 3a money taxed?

Anyone who withdraws pension funds from the second or third pillar must pay a so-called capital gains tax. This is levied separately from other income. The federal government applies one-fifth of the ordinary income tax rate. In concrete terms, this amounts to 3'903 Swiss francs on a withdrawal of 250'000 Swiss francs, for example.

The cantons and municipalities will also ask you to pay your fair share. The differences are significant, especially for large withdrawals (see chart). For example, if a single person in Herisau (AR) withdraws 250'000 Swiss francs from a 3a account, they have to pay almost 18'600 Swiss francs to the tax authorities. For the same amount in Chur, the tax authorities of Grisons are satisfied with 6'862 Swiss francs.

How can you optimize your taxes?

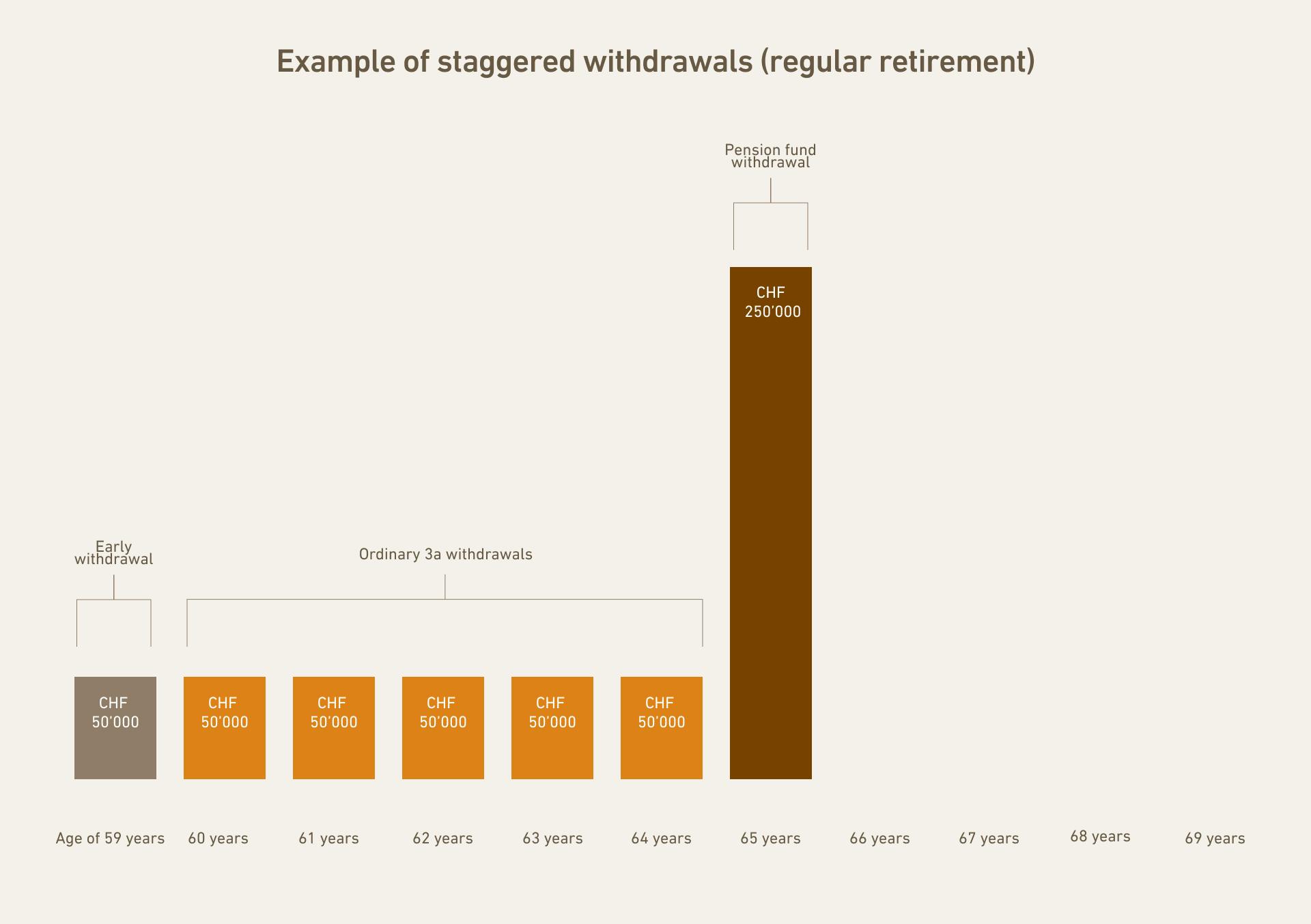

Basically, taxation on pension funds is progressive. In other words, the more money you withdraw, the higher the tax rate. That's why you should withdraw your pension funds in several small packages. With True Wealth, this staggered withdrawal is easy because five 3a accounts are automatically opened when you make payments over the years.

The following example illustrates the benefits: A single person in Aarau withdraws 250'000 Swiss francs from their 3a account. They pay 17'859 Swiss francs in taxes. Their neighbor withdrew the same amount spread over five years. This cost her five times 1'584, or 7'920 Swiss francs. She therefore paid almost 10'000 Swiss francs less in taxes than her neighbor.

And please note: anyone planning to make a lump-sum withdrawal from their second pillar should not withdraw any 3a money in the corresponding year. The corresponding accumulation would lead to a progressive tax rate and thus to an unnecessarily high tax burden.

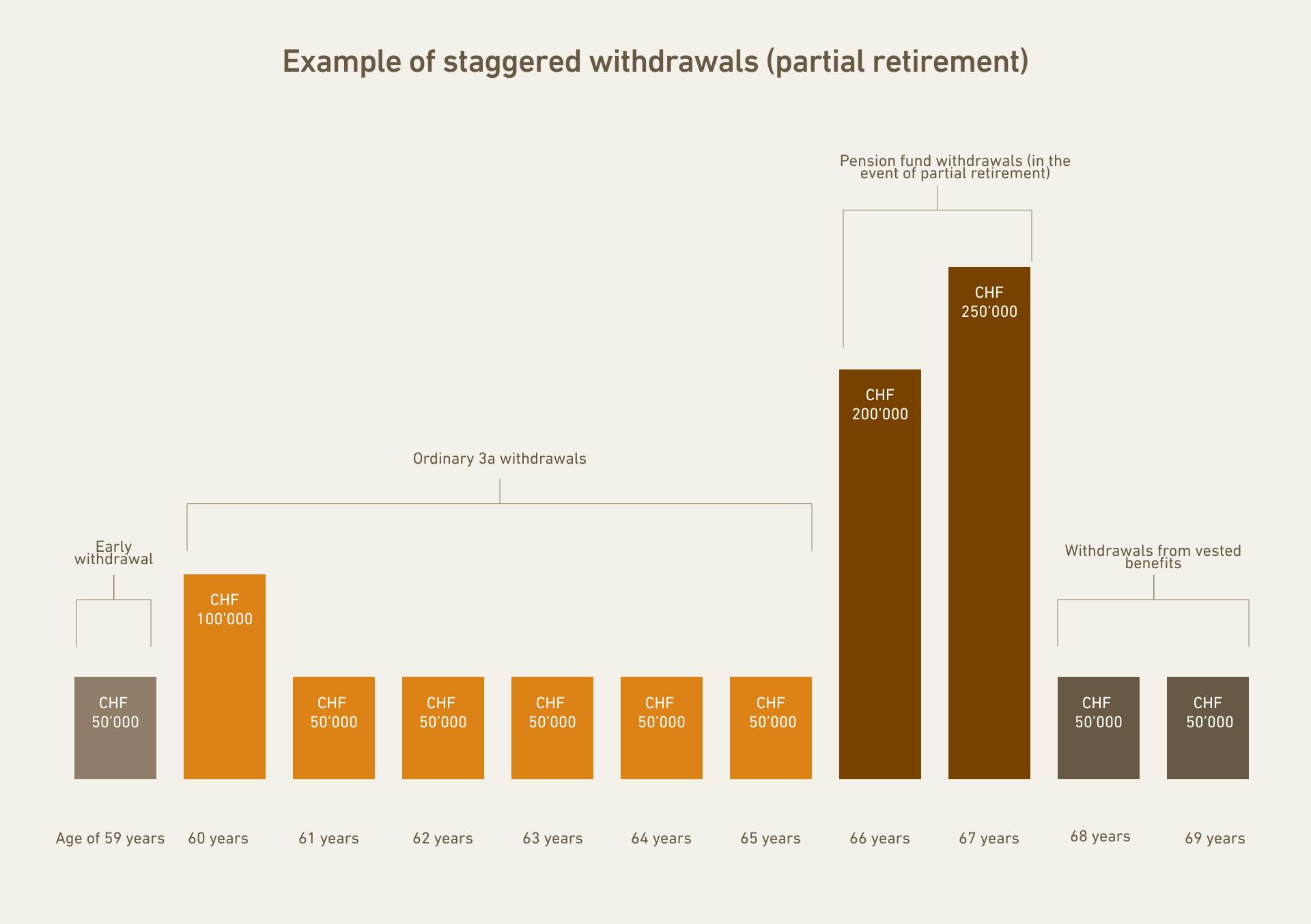

If your employer and pension fund allow it, partial retirement is recommended. This allows you to withdraw your pension fund assets in two different years: first when you reduce your working hours and then when you reach retirement age (see column chart).

Married couples should plan particularly carefully. Until further notice, they are considered a single tax entity, meaning that the pension funds received by the husband and wife in the same year are added together and taxed accordingly. It is therefore important to ensure that the husband's 3a funds are not also taxed in the year in which the wife's pension fund assets are withdrawn. At the beginning of June 2025, parliament decided in favor of individual taxation. In the future, spouses will be taxed separately, which could simplify the planning of pension withdrawals. However, there will be a referendum on this issue. The final decision will therefore be made by the people.

Use the official federal tax calculator Capital withdrawal from pension plans to help you plan.

When is early withdrawal possible?

If you are under 60, you can withdraw your 3a funds or funds from your second pillar (pension fund, vested benefits) to finance the purchase of your own home. This refers to a property that you will live in permanently, i.e. not a vacation home or investment property.

Early withdrawal can also be used to pay off (part of) a mortgage or renovate your home.

Even if you emigrate, i.e. leave Switzerland permanently, you can still make an early withdrawal from your Pillar 3a account. You will only receive the money once you can provide written confirmation of residence in your country of destination. As you no longer have a tax domicile in Switzerland, the amount withdrawn will be taxed at the location of the pension fund. This opens up potential for optimization: anyone emigrating should transfer their retirement assets to a foundation in a canton with low capital gains taxes before leaving. These include Basel-Landschaft, where True Wealth's pension fund is based.

Disability is an unfortunate reason for early withdrawal of 3a funds. The condition is that you must be receiving a full disability annuity, which requires a degree of disability of at least 70 percent.

Finally, there is some good news for founders of sole proprietorships or partnerships. Anyone who becomes self-employed is also entitled to withdraw their 3a funds early. However, anyone who found a corporation or limited liability company is legally considered an employee and therefore does not receive any start-up capital from Pillar 3a.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account