How much Russia is there in my portfolio?

How large is the share of Russian shares or bonds in my portfolio? And do I have to do anything to reduce it?

Since the invasion of Russian troops in Ukraine, Western countries have been imposing sanctions to put Russia in its place. Switzerland, too, for the first time. And many private investors also no longer want to invest their money in Russia.

Are you now asking yourself: How big is the share of Russia in my portfolio? Then find out here how little Russia is currently in your portfolio. And what you can do to exclude Russia completely.

Economically, Russia is not a world power

By the measure of its armed forces, Russia may be a world power. Economically, however, Russia's importance has been waning for some time, despite its vast expanse and abundance of raw materials.

In MSCI's emerging market benchmark, Russia's equity market currently has a weight of around 3 per cent. And for the world as a whole, Russia's share is vanishingly small at 0.3 per cent.

Sanctions automatically take effect in the portfolio

The sanctions imposed by Western countries have also added to this. Russia's stock markets have fallen since the invasion. After the exclusion from the international payment system SWIFT, they have crashed even further. This automatically reduces the share of Russian securities in any portfolio.

We have calculated this across all client portfolios: The proportion of Russian securities at True Wealth is currently at two tenth of a percent. If you want to reduce it even further, let's go into detail on how to do it.

How many Russian securities are in my portfolio?

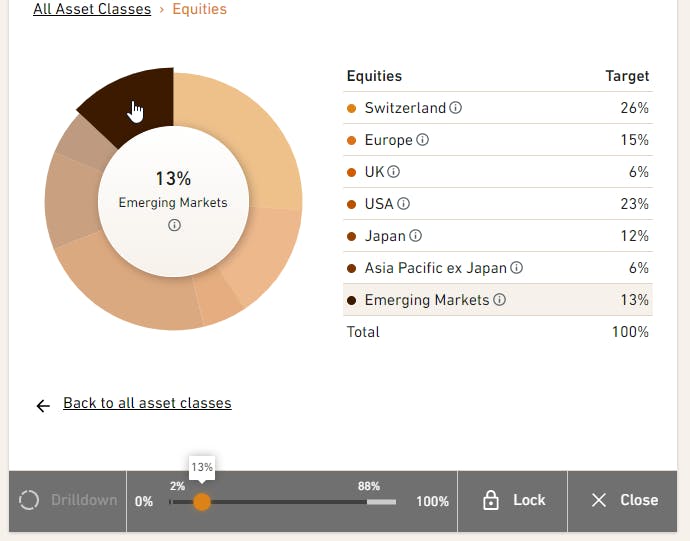

Do I hold shares in Russian companies or Russian bonds in my portfolio? If you are invested with True Wealth, the answer is quite simple. We never offer Russia separately, only through emerging market indices.

Russia as part of emerging market equities

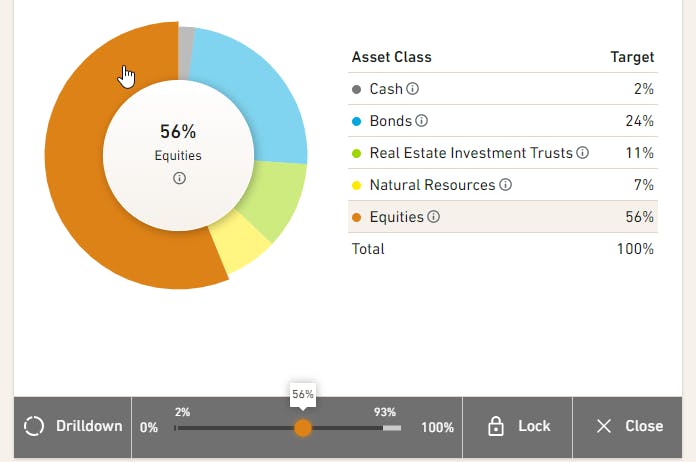

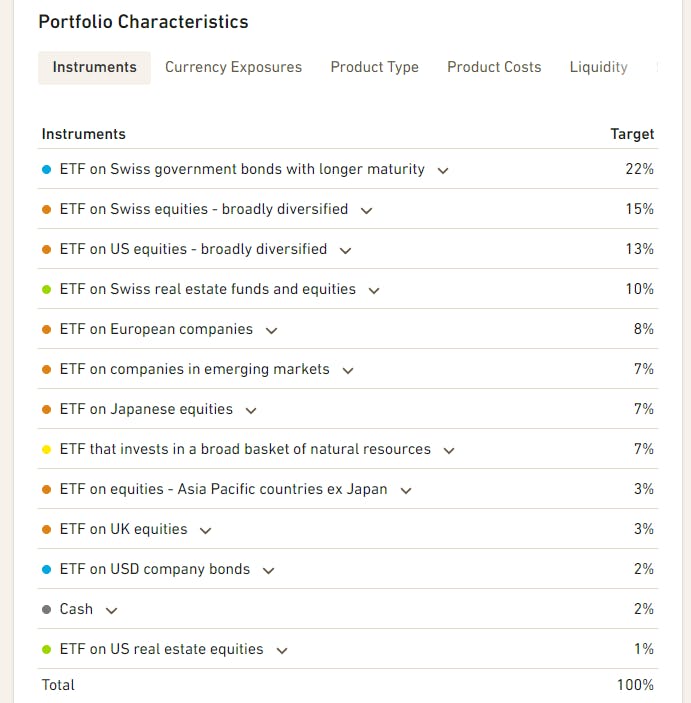

True Wealth's investment universe consists of over 50 ETFs. Depending on the clients' risk tolerance, the portfolios also include an ETF on emerging market equities. In this ETF, about 3 percent falls on shares of Russian companies.

If you have chosen the sustainable universe at True Wealth, the proportion is even significantly lower. You can quickly check whether your portfolio contains emerging market equities in the graphical representation of your investment mix.

Russia as part of emerging market bonds

Russian bonds are not included in your portfolio separately either, only as part of an ETF on emerging market bonds. As with equities, the proportion is small, between 1 and 2 per cent depending on the ETF.

Russia as part of global real estate equities

In some of our clients' portfolios, an ETF on globally diversified real estate stocks (excluding the USA) is also used. Here, the Russia portion is about 0.05 percent.

How can I exclude Russian securities completely?

Do you want to completely exclude Russian stocks and bonds in your asset management? Russia is never singled out in your portfolio. At True Wealth, Russian stocks may be included in ETFs on emerging market indices.

This also means that if you want to completely exclude Russian securities from your portfolio today, you have to remove all emerging markets. If you want to trade today, simply set the weighting of the corresponding ETF to zero.

You can read exactly how this works here.

We do not charge you any additional asset management fees for strategy adjustments, and brokerage fees are also included (see here). However, the necessary rebalancing will incur one-off price losses due to the ETF's bid-ask spread, and stamp duty will apply.

Will the ETF exclude Russia?

You may not have to do anything at all to exclude Russia from your portfolio. This is because the providers of the ETF and the underlying indices are also working on solutions. For index providers, the question is not only one of political stance and reputation.

They also have to ensure in a very practical way that the indices only contain securities that are also traded in a liquid manner. Due to the international sanctions and the exclusion of Russian banks from the SWIFT network, the liquidity and tradability of Russian stocks and bonds has plummeted.

Passive portfolios automatically with less Russia

The index providers MSCI and FTSE decided at the beginning of March to exclude Russia indices from emerging markets and treat them as a separate category. For MSCI, the exclusion will take place next Wednesday, 9 March 2022. For FTSE, the change will take effect as early as Monday, 7 March.

It can be assumed that other index providers such as JP Morgan will possibly act similarly to FTSE and MSCI. This will then automatically lead to the complete disappearance of Russian stocks and bonds from passively invested portfolios over time.

Links

- https://www.msci.com/eqb/pressreleases/archive/PR_Russia_Classification.pdf

- https://www.ft.com/content/3f990158-b8e8-4291-9ae1-997974533a45

- https://www.wsj.com/livecoverage/russia-ukraine-latest-news-2022-02-28/card/msci-signals-potential-exclusion-of-russia-from-influential-indexes-0lZvVl1usUUc2wQXo2LH

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account