Introduction to occupational pension plans (BVG)

BVG series part I

Almost all employees and some self-employed persons are insured in a pension fund. Many questions and political debates revolve around the so-called second pillar. The following blog addresses key points.

For many working people, their pension fund savings represent the most significant portion of their assets. In Switzerland, around 4.7 million people can count on occupational pension provision. This is ensured by around 1'300 pension funds, which manage over 1'200 billion francs. That is a good 255'000 francs per insured person.

How does occupational pension systems differ from state pension scheme?

The state-organized first pillar of the pension system is designed to secure livelihoods in old age (OASI or AHV) and in the event of disability (DI or IV). It operates on a pay-as-you-go basis: contributions from the current working population, together with federal contributions, are used directly to pay pensions to current pensioners and disabled persons.

The second pillar, occupational pension provision, on the other hand, is based on a funded system. In principle, everyone saves their own retirement capital with the help of their employer. At first glance, there is no provision for redistribution, for example from the working generation to the retired generation. However, politicians determine the minimum interest rate (1.25 percent, as of 2025) at which pension funds must pay interest on the mandatory portion of the retirement capital of the working population each year, and the key – the conversion rate – at which they must convert the mandatory retirement capital into an annual pension upon retirement.

This led to a significant redistribution between 2014 and 2020. The Occupational Pension Supervisory Commission (OPSC) estimates that working people had to cross-subsidize pensioners with over 40 billion francs. The cause was demographic in nature: during this period, many older employees took (early) retirement with what are now considered high pensions. At the same time, however, too few new workers entered the labor market. To make matters worse, US key interest rates rose between 2015 and 2019, which weighed on international bond prices and thus on pension funds. Between 2015 and 2022, the key interest rate in Switzerland was below zero, which made it virtually impossible to generate a risk-free return.

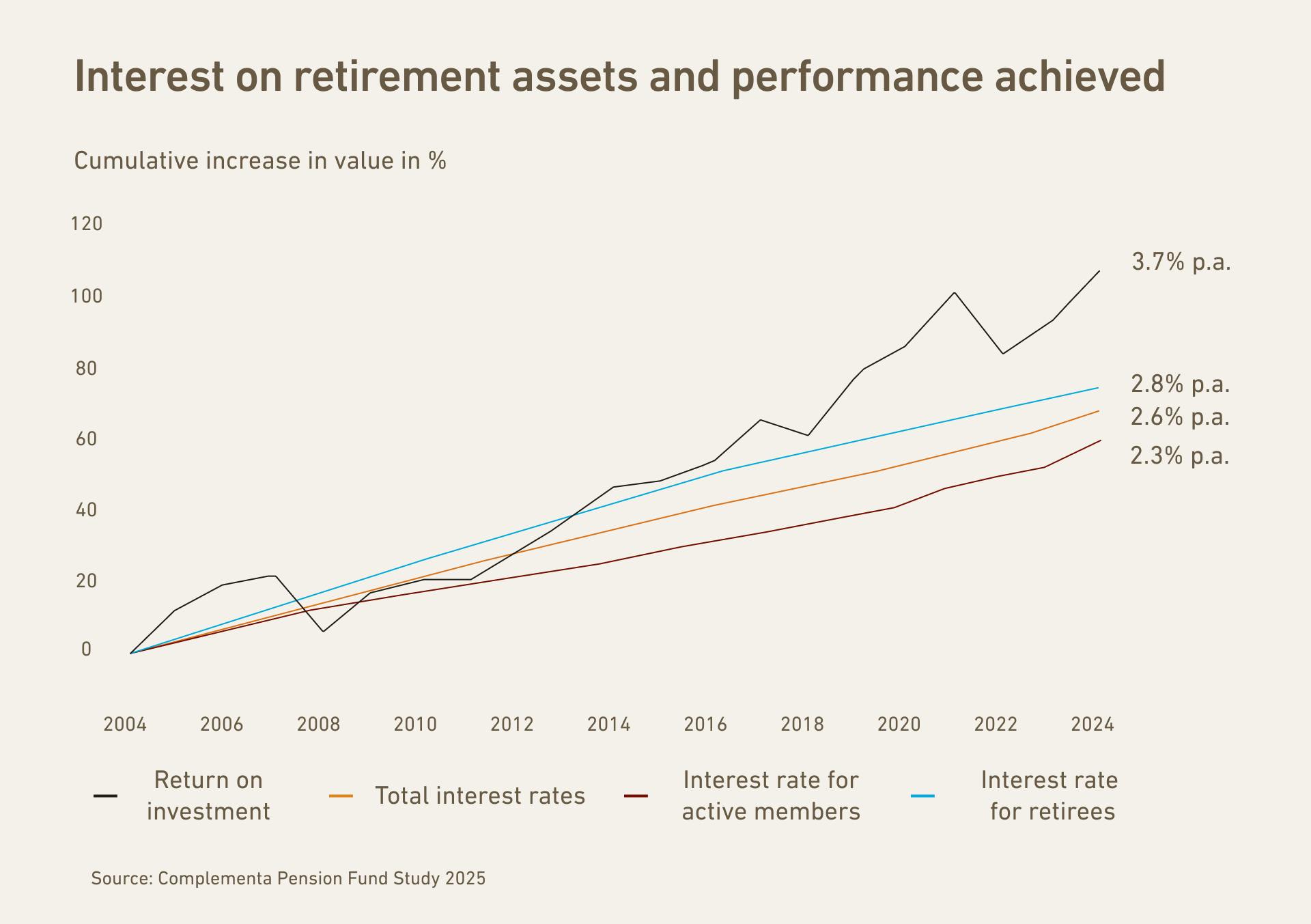

But how did this redistribution, which is alien to the system and should not take place in a funded pension scheme, work? Quite simply: pension funds only gave employees a portion of the returns they generated on the financial markets. On the other hand, the funds paid significantly higher interest rates on pensioners' assets in order to finance their pensions (see chart).

Combined, all these factors meant that pension funds had to use part of the contributions paid by working people to pay out the guaranteed pensions of retirees. This problem has eased in recent years. On the one hand, pension funds are constantly lowering the conversion rates that determine pensions, and on the other hand, there have been very good investment years since then – with the exception of 2022. Strictly speaking, pension funds can only determine the conversion rates in the extra-mandatory portion (see definition below). This is because the mandatory portion is subject to the statutory rate of 6.8 percent. Ultimately, the pension is determined by the overall rate. This is calculated using a mixed calculation – depending on how much credit the pension recipient has in the two parts of their fund.

One of the aims of the Occupational Pensions Act (BVG) is that pensions from the second pillar, together with those from the AHV, can replace 60 percent of the last earned income. The 60 percent figure is not specified in either the constitution or the law, which refer to the continuation of the accustomed standard of living in an appropriate manner. However, the 60 percent figure has become established as a benchmark in politics since the Federal Council quantified the target in its 1975 message on the BVG.

Who is insured in a pension fund?

Since 1985, all employees aged 18 and over have been compulsorily insured against the risks of disability and death. This is a key difference to private pension provision (pillar 3a), which is voluntary. However, mandatory retirement savings under the second pillar only begin at the age of 25. The condition is that you earn more than 22'680 francs per year. This so-called entry threshold always corresponds to three quarters of the maximum AHV pension for a single person. It currently amounts to 30'240 francs per year and is regularly adjusted by the Federal Council in line with inflation and wage developments.

Self-employed persons can also take out voluntary occupational pension insurance, for example through the fund of the relevant industry association.

What risks does the pension fund insure?

The occupational pension plan insures against the risks of death and disability. In the event of death, it pays out widows', widowers', and orphans' pensions. In the event of incapacity to work, there is a disability pension for those affected and their children.

Can you choose your pension fund?

In practice, it is the employer who decides which pension fund their employees are insured with. While large corporations often have their own funds, smaller companies can join so-called collective foundations. The Occupational Pensions Act (BVG) provides for «equal co-determination rights in employee pension provision.» The responsible body is the pension commission. It consists of at least one employee representative and one employer representative from the company.

How much is the BVG deduction?

The BVG contribution is paid equally by employers and employees, with the former able to contribute more on a voluntary basis. But what percentage of your salary do you pay into the pension fund? In the first phase of your working life, the BVG deduction is at least 7 percent of your insured salary (see next section). This applies until the insured person reaches the age of 35. After that, one-tenth of the insured salary goes into the pension fund. From the age of 45, the contribution is 15 percent, and from 55 until retirement, it is as high as 18 percent. Employees see their pension fund contributions on their monthly pay slips in the form of a deduction.

What is the insured salary?

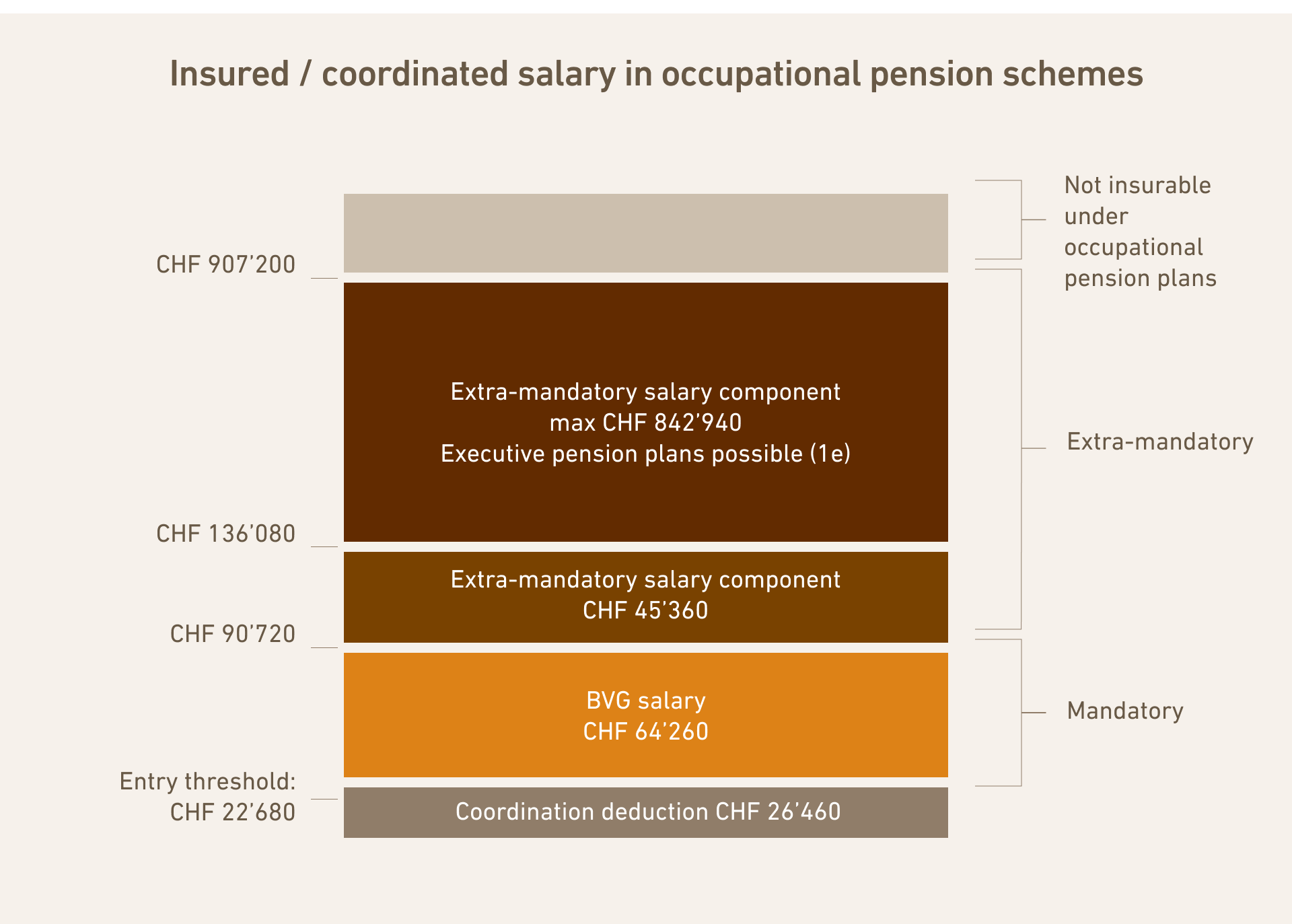

The second pillar insures what is known as the coordinated salary. It coordinates the first pillar with the second. This prevents double insurance. The AHV covers the first 26'460 francs of salary, while the pension fund is responsible for salary components above this amount. So if someone earns 90'000 francs gross, the salary insured by the pension fund after the coordination deduction is 63'540 francs.

What does mandatory BVG mean?

The BVG only regulates the mandatory part of the second pillar. In figures, this always corresponds to three times the maximum AHV pension. This equates to gross salaries of up to 90'720 francs per year (as of 2025). Anything above this is insured under the so-called non-mandatory portion. Less stringent rules apply here, for example with regard to the minimum interest rate on retirement assets. This is currently 1.25 percent for the mandatory portion.

If the pension fund regulations provide for it, there are 1e savings plans, known as executive pension plans, for certain groups of employees and for salaries above 136'080 francs per year. This allows individual insured persons to choose their own investment strategy, for example with a higher proportion of equities.

There is also an upper limit. The maximum salary that can be insured in a regular pension fund is 907'200 francs per year – a level that only a few employees reach. This upper limit has been in place since the beginning of 2006. It was introduced as part of the «Lex Barnevik,» named after former ABB CEO Percy Barnevik. He abused the second pillar as a vehicle for tax optimization by buying into the pension fund with millions of francs.

Where do the contributions go?

On average, around 82 percent of pension fund contributions go into the savings portion, with the rest going toward insurance premiums in the risk portion and a small portion going toward administration. Pension funds invest the money on the capital markets, mainly in equities (29%), bonds (27%) and real estate (24%), according to Swisscanto's annual pension fund study. The return generated is also referred to as «the third contributor.» Since 2004, it has contributed 38 percent to occupational pension assets. According to Swisscanto, pension funds have achieved an average annual return of 3.5 percent over the past ten years.

What does the coverage ratio show?

Stock market performance has a direct impact on the health of a pension fund. One key indicator of this is the coverage ratio. This percentage shows what proportion of liabilities are covered by assets. Overall, the average coverage ratio at the end of 2024 was over 114 percent, according to a report published by the Occupational Pension Supervisory Commission (OPSC) in May 2025.

If the percentage is below 100 percent, this is referred to as a «shortfall». A «minor» shortfall can be offset within five years without restructuring measures, for example through good investment results and/or lower conversion rates.

In the case of a «significant» shortfall, restructuring measures must be initiated. These measures include, for example, reducing the interest rate on retirement assets and levying restructuring contributions from employees and employers.

While most private pension funds have a healthy coverage ratio, this is not the case for all public pension funds. If the shortfall of a public pension fund becomes too large, taxpayers have to step in. This was demonstrated by the cases of the Bernese Teachers' Insurance Fund (2003), the SBB Pension Fund (2010), and the Pension Fund of the City of Winterthur (2024).

When does the pension fund start paying retirement benefits?

A retirement pension is generally paid from the age of 65. In September 2022, voters decided that the reference age for women would be raised by one year from 64 to 65. The reference age is now being adjusted gradually. Officially, women born in 1961 will retire at the age of 64 years and three months in 2025. In 2026, women born in 1962 will reach their reference age of 64.5 years. Those born in 1963 will be able to retire in 2027 after 64 years and nine months. Of course, there is always the possibility of early retirement or the option to continue working beyond the reference age.

Conclusion: The second pillar is a central element of the Swiss pension system. In the second part, you will learn how pensions are calculated, what to do when changing jobs, how to access your pension fund money before reaching retirement age, what to consider when making regular withdrawals, and what to look out for when making voluntary purchases into the pension fund.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account